Charting the Future: Cryptocurrency Trends in 2025

Related Articles: Charting the Future: Cryptocurrency Trends in 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Charting the Future: Cryptocurrency Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Charting the Future: Cryptocurrency Trends in 2025

The world of cryptocurrency is constantly evolving, with new technologies, applications, and regulations emerging at a rapid pace. While predicting the future with certainty is impossible, analyzing current trends and market dynamics can provide valuable insights into the potential landscape of cryptocurrency trends in 2025. This exploration delves into key areas shaping the future of this dynamic industry, offering a comprehensive understanding of its potential trajectory.

1. Institutional Adoption and Integration:

The year 2025 is likely to witness a significant surge in institutional adoption of cryptocurrencies. As regulatory clarity increases and institutional investors become more comfortable with the asset class, traditional financial institutions are expected to embrace cryptocurrencies more readily. This trend will be driven by several factors:

- Increased Regulatory Framework: Clearer and more comprehensive regulatory frameworks are anticipated, providing a stable environment for institutional investors to navigate.

- Growing Institutional Demand: Large institutions are increasingly recognizing the potential of cryptocurrencies as an asset class, with some already actively investing in them.

- Development of Institutional-Grade Infrastructure: The development of specialized platforms and services catered to institutional investors will further facilitate their entry into the crypto market.

This shift will lead to a more mature and stable cryptocurrency market, characterized by increased liquidity, reduced volatility, and greater accessibility for institutional investors.

2. Decentralized Finance (DeFi) Expansion:

Decentralized finance (DeFi) has emerged as a transformative force within the cryptocurrency ecosystem. By leveraging blockchain technology, DeFi enables access to financial services without reliance on traditional intermediaries. The year 2025 is likely to see further expansion and innovation in DeFi, with key trends including:

- Growth of DeFi Applications: The DeFi landscape will continue to expand, with new applications emerging across various sectors, including lending, borrowing, trading, and insurance.

- Improved User Experience: DeFi platforms will prioritize user experience, making it easier for individuals to access and utilize these services.

- Interoperability and Cross-Chain Compatibility: Increased interoperability between different blockchains will facilitate seamless transactions and data exchange across DeFi platforms.

DeFi holds the potential to revolutionize the financial system by providing greater accessibility, transparency, and control to users.

3. Non-Fungible Tokens (NFTs) and the Metaverse:

Non-fungible tokens (NFTs) have gained significant traction in recent years, revolutionizing digital ownership and creating new avenues for creators and artists. The year 2025 is expected to witness the continued growth of NFTs, with a particular focus on their integration within the metaverse:

- NFT-based Metaverse Experiences: NFTs will play a crucial role in shaping metaverse experiences, enabling ownership of virtual assets, land, and other digital objects.

- NFT-powered Digital Collectibles: The market for NFT-based digital collectibles, including art, music, and gaming items, is likely to expand significantly.

- NFT-based Identity and Reputation Systems: NFTs can potentially serve as a foundation for decentralized identity and reputation systems, enhancing user privacy and security.

The convergence of NFTs and the metaverse is expected to create new opportunities for creators, businesses, and users, fostering a vibrant and interconnected digital world.

4. Central Bank Digital Currencies (CBDCs):

Central banks around the world are actively exploring the development and implementation of central bank digital currencies (CBDCs). These digital versions of fiat currencies offer the potential to enhance efficiency, reduce costs, and improve financial inclusion. The year 2025 could see a significant increase in CBDC adoption:

- Pilot Programs and Early Implementations: Several countries are likely to launch pilot programs or implement CBDCs on a limited scale.

- Interoperability and Cross-Border Payments: CBDCs could facilitate faster and more efficient cross-border payments, reducing costs and increasing accessibility.

- Financial Inclusion and Access: CBDCs have the potential to expand financial inclusion by providing access to financial services for individuals and businesses previously excluded from the traditional system.

The rise of CBDCs could have a profound impact on the global financial landscape, potentially influencing the future of traditional currencies and the role of central banks.

5. Web3 and Decentralized Applications (DApps):

Web3, the next iteration of the internet, is built on blockchain technology and decentralized applications (DApps). It aims to create a more open, transparent, and user-centric internet, empowering individuals and disrupting traditional centralized systems. In 2025, Web3 and DApps are expected to gain further momentum:

- Growth of DApps in Various Sectors: DApps are likely to emerge across a wide range of sectors, including gaming, social media, finance, and healthcare.

- Increased User Adoption: As Web3 technologies become more accessible and user-friendly, user adoption is expected to increase significantly.

- Decentralized Governance and Community Ownership: Web3 platforms will emphasize decentralized governance, allowing users to participate in decision-making and community ownership.

Web3 has the potential to revolutionize how we interact with the internet, creating a more inclusive and equitable digital ecosystem.

6. Security and Scalability Improvements:

As the cryptocurrency ecosystem matures, addressing security and scalability challenges becomes increasingly crucial. The year 2025 is expected to see advancements in these areas:

- Enhanced Security Measures: Blockchain platforms will continue to enhance security measures to mitigate risks associated with hacks, fraud, and other vulnerabilities.

- Scalability Solutions: New solutions will be implemented to improve the scalability of blockchain networks, enabling faster transaction speeds and lower costs.

- Layer-2 Solutions: Layer-2 solutions will play a vital role in enhancing scalability, offering faster and more efficient transaction processing without compromising security.

These advancements will contribute to a more robust and sustainable cryptocurrency ecosystem, attracting wider adoption and investment.

7. Regulatory Landscape Evolution:

The regulatory landscape surrounding cryptocurrencies is constantly evolving, with governments and regulatory bodies around the world seeking to establish clear guidelines and frameworks. In 2025, we can anticipate further developments in this area:

- Increased Regulatory Clarity: Governments are expected to provide more clarity on regulations governing cryptocurrencies, fostering a more stable and predictable environment for investors and businesses.

- Global Cooperation on Regulation: International collaboration on regulatory frameworks will be crucial to ensure consistency and prevent regulatory arbitrage.

- Focus on Consumer Protection: Regulations will likely prioritize consumer protection, addressing issues such as anti-money laundering, Know Your Customer (KYC), and investor protection.

A clear and consistent regulatory framework will be essential for the long-term growth and sustainability of the cryptocurrency industry.

8. Sustainability and Environmental Impact:

The environmental impact of cryptocurrency mining has become a growing concern. In 2025, we can expect initiatives aimed at promoting sustainability within the cryptocurrency ecosystem:

- Energy-Efficient Mining Techniques: The development and adoption of more energy-efficient mining techniques will be crucial to reduce the environmental footprint of cryptocurrency mining.

- Renewable Energy Sources: Increased reliance on renewable energy sources for mining operations will contribute to a more sustainable industry.

- Proof-of-Stake Consensus Mechanisms: Proof-of-stake (PoS) consensus mechanisms, which are more energy-efficient than proof-of-work (PoW), are likely to gain wider adoption.

Addressing the environmental concerns associated with cryptocurrency mining will be essential for its long-term viability and acceptance.

Related Searches:

1. Cryptocurrency Market Predictions 2025:

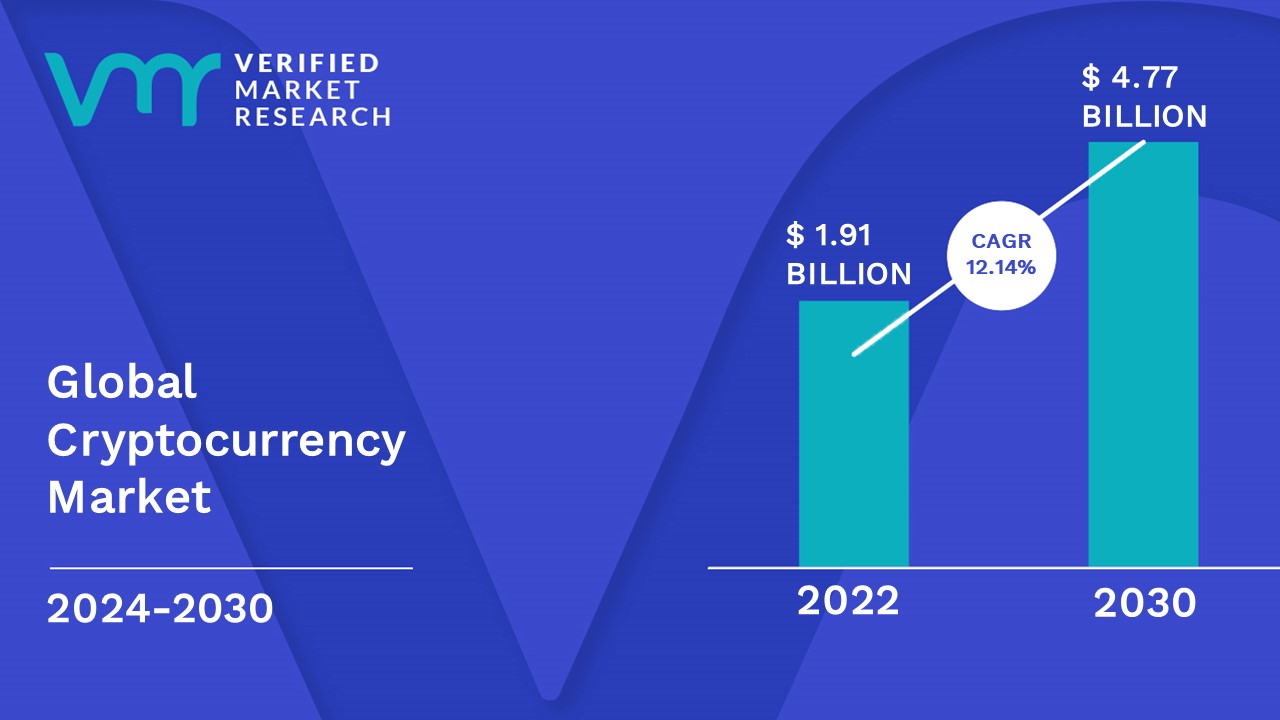

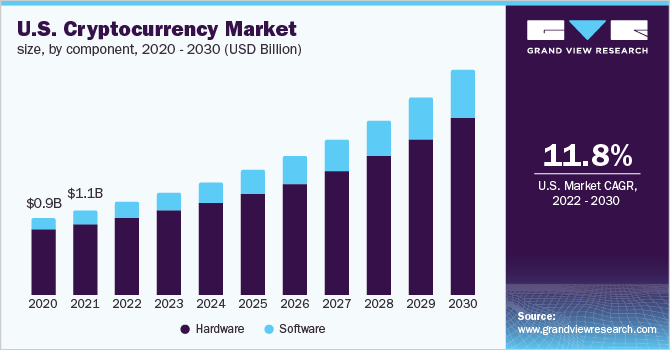

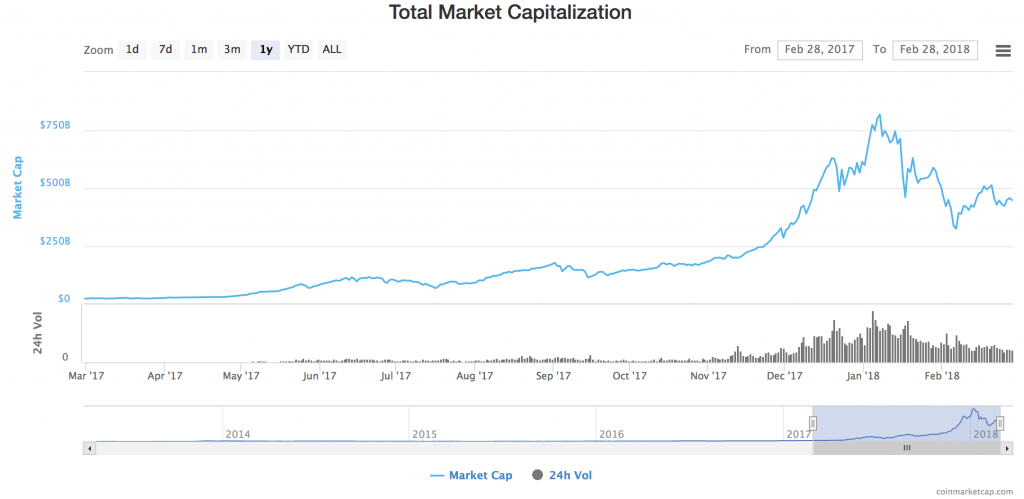

Market predictions for 2025 are highly speculative, but experts anticipate continued growth in the overall cryptocurrency market. Factors influencing this growth include increased institutional adoption, expansion of DeFi, and the emergence of new use cases for cryptocurrencies. However, volatility remains a key characteristic of the cryptocurrency market, and predictions are subject to change based on various factors.

2. Top Cryptocurrency Investments 2025:

Identifying top cryptocurrency investments for 2025 requires careful consideration of various factors, including market capitalization, project development, team expertise, and regulatory landscape. While some established cryptocurrencies are likely to maintain their position, emerging projects with innovative solutions and strong fundamentals could emerge as potential investment opportunities.

3. Future of Bitcoin in 2025:

Bitcoin, the first and most well-known cryptocurrency, is expected to remain a dominant force in 2025. Its limited supply, established track record, and increasing institutional adoption contribute to its ongoing appeal. However, the future of Bitcoin will also depend on factors such as regulatory developments, competition from other cryptocurrencies, and advancements in blockchain technology.

4. Cryptocurrency Regulations 2025:

Regulatory clarity and consistency are crucial for the growth and stability of the cryptocurrency industry. In 2025, we can anticipate continued development of regulatory frameworks, with a focus on consumer protection, anti-money laundering, and investor protection. Different jurisdictions will likely adopt varying approaches to regulation, leading to a fragmented landscape.

5. Cryptocurrency Use Cases 2025:

The use cases for cryptocurrencies are constantly expanding beyond traditional financial applications. In 2025, we can expect to see wider adoption of cryptocurrencies in sectors such as supply chain management, identity verification, and gaming. The development of new technologies and applications will further drive the adoption of cryptocurrencies across various industries.

6. Cryptocurrency Trading Strategies 2025:

Cryptocurrency trading strategies will continue to evolve as the market matures. In 2025, investors may consider strategies such as dollar-cost averaging, technical analysis, and fundamental analysis. Risk management will remain crucial, as the cryptocurrency market is known for its volatility.

7. Cryptocurrency Risks 2025:

Cryptocurrency investments carry inherent risks, including market volatility, security vulnerabilities, and regulatory uncertainty. In 2025, investors should be aware of these risks and implement appropriate risk management strategies. Diversification and thorough research are essential for mitigating potential losses.

8. Cryptocurrency Education 2025:

As the cryptocurrency industry grows, the demand for education and resources will increase. In 2025, we can expect to see more online courses, workshops, and educational materials available to individuals seeking to learn about cryptocurrencies and blockchain technology.

FAQs:

1. Will cryptocurrencies become mainstream in 2025?

While widespread adoption is still a long-term goal, cryptocurrency trends in 2025 suggest a significant increase in mainstream acceptance. Increased institutional adoption, regulatory clarity, and the development of user-friendly platforms are expected to contribute to this trend.

2. What are the biggest challenges facing the cryptocurrency industry in 2025?

The cryptocurrency industry faces several challenges, including regulatory uncertainty, security vulnerabilities, scalability limitations, and the environmental impact of mining. Addressing these challenges will be crucial for the industry’s long-term growth and sustainability.

3. Are cryptocurrencies a good investment in 2025?

Cryptocurrency investments carry significant risks, and past performance is not indicative of future returns. Investors should conduct thorough research, understand the risks involved, and implement appropriate risk management strategies before investing.

4. What are the potential benefits of cryptocurrencies in 2025?

Cryptocurrencies offer several potential benefits, including increased financial inclusion, faster and cheaper transactions, greater transparency, and new opportunities for innovation. However, the realization of these benefits depends on various factors, including regulatory developments, technological advancements, and widespread adoption.

5. How can I get started with cryptocurrencies in 2025?

Getting started with cryptocurrencies involves several steps, including choosing a reputable cryptocurrency exchange, creating an account, verifying your identity, and selecting a cryptocurrency to purchase. It is important to conduct thorough research, understand the risks involved, and start with a small amount of investment.

6. Is cryptocurrency mining still profitable in 2025?

The profitability of cryptocurrency mining depends on several factors, including the price of the cryptocurrency, the cost of electricity, and the efficiency of mining hardware. As the industry evolves, competition increases, and energy costs fluctuate, the profitability of mining may vary.

7. What is the future of cryptocurrency regulation?

The future of cryptocurrency regulation is uncertain, but we can expect continued efforts by governments and regulatory bodies to establish clear guidelines and frameworks. The focus will likely be on consumer protection, anti-money laundering, and investor protection.

8. What is the impact of cryptocurrency on the financial system?

Cryptocurrencies have the potential to disrupt the traditional financial system by offering alternative payment methods, decentralized financial services, and new investment opportunities. However, the full impact of cryptocurrencies on the financial system is still evolving and subject to various factors, including regulatory developments and technological advancements.

Tips:

- Stay Informed: Keep up-to-date on the latest developments in the cryptocurrency industry by reading reputable news sources, attending industry events, and following thought leaders on social media.

- Diversify Your Portfolio: Do not invest all your funds in a single cryptocurrency. Diversify your portfolio across multiple cryptocurrencies and other asset classes to mitigate risk.

- Invest Wisely: Conduct thorough research before investing in any cryptocurrency. Consider factors such as market capitalization, project development, team expertise, and regulatory landscape.

- Secure Your Assets: Use strong passwords, enable two-factor authentication, and store your cryptocurrencies in secure wallets.

- Practice Risk Management: Understand the risks associated with cryptocurrency investments and implement appropriate risk management strategies.

- Consider the Environmental Impact: Support projects and initiatives that prioritize sustainability and environmental responsibility.

Conclusion:

The year 2025 is poised to be a pivotal year for the cryptocurrency industry, with significant developments expected across various sectors. Increased institutional adoption, expansion of DeFi, growth of NFTs and the metaverse, and the emergence of CBDCs are likely to reshape the landscape of finance and technology. While challenges remain, the potential for cryptocurrency trends in 2025 to revolutionize the financial system and create new opportunities for individuals and businesses is undeniable. By staying informed, investing wisely, and embracing innovation, stakeholders can navigate this evolving landscape and capitalize on the transformative potential of cryptocurrencies.

Closure

Thus, we hope this article has provided valuable insights into Charting the Future: Cryptocurrency Trends in 2025. We appreciate your attention to our article. See you in our next article!