Navigating the Evolving Landscape: Bank Industry Trends in 2025

Related Articles: Navigating the Evolving Landscape: Bank Industry Trends in 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Evolving Landscape: Bank Industry Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Evolving Landscape: Bank Industry Trends in 2025

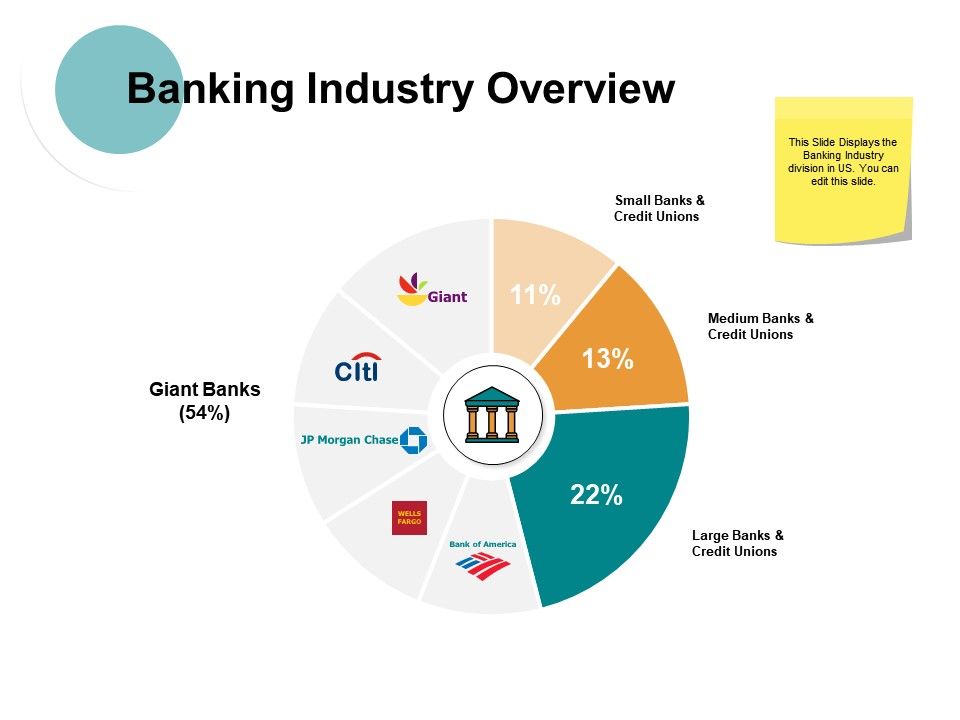

The banking industry is undergoing a rapid transformation, driven by technological advancements, evolving customer expectations, and a changing regulatory environment. By 2025, the landscape will be significantly different, demanding banks to adapt and embrace innovation to remain competitive. This article delves into key bank industry trends in 2025, providing insights into the forces shaping the future of banking.

1. The Rise of Open Banking and Data-Driven Services

Open banking is revolutionizing the financial services industry by enabling secure sharing of customer financial data with third-party providers. This creates opportunities for innovative financial products and services tailored to individual needs. Banks are increasingly adopting open banking APIs to offer seamless integration with fintech platforms, allowing customers to manage their finances across multiple accounts from a single interface.

-

Benefits of Open Banking:

- Enhanced customer experience: Customers gain access to personalized financial insights and customized financial solutions.

- Increased competition and innovation: Open banking fosters a more competitive environment, driving innovation in financial products and services.

- Improved financial inclusion: Open banking can facilitate access to financial services for underserved populations by enabling new business models.

2. The Growing Influence of Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are transforming the banking industry by automating processes, improving risk assessment, and personalizing customer interactions. Banks are leveraging AI-powered chatbots for customer support, using ML algorithms for fraud detection, and employing AI-driven analytics for better risk management.

-

Applications of AI and ML in Banking:

- Personalized financial advice: AI-powered tools can analyze customer data and provide personalized financial advice, including budgeting, investment recommendations, and loan eligibility assessments.

- Automated customer service: AI-powered chatbots can handle routine customer inquiries, freeing up human agents for more complex tasks.

- Fraud detection and prevention: ML algorithms can identify suspicious transactions and patterns, enabling banks to proactively prevent fraudulent activity.

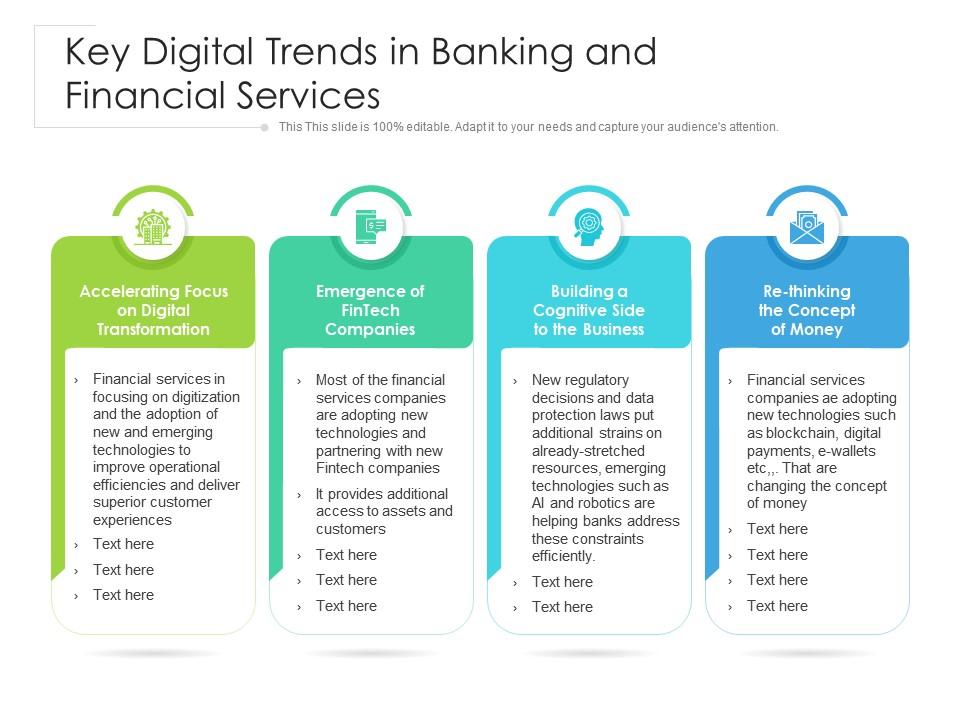

3. The Emergence of Fintech and the Competition for Market Share

Fintech companies are disrupting traditional banking models by offering innovative and customer-centric financial solutions. They are often more agile and tech-savvy, leveraging technology to provide faster, more convenient, and more transparent services. Banks are facing increasing pressure to compete with fintechs, requiring them to adopt a more innovative and customer-focused approach.

-

Fintech’s Impact on Banking:

- Challenger banks: Fintech companies are launching digital-only banks that offer streamlined services and lower fees, attracting a growing segment of customers.

- Specialized services: Fintechs are focusing on specific niches, such as payments, lending, and wealth management, offering tailored solutions to meet specific customer needs.

- Partnerships and acquisitions: Banks are increasingly partnering with or acquiring fintech companies to access their technology and innovation.

4. The Shift Towards Digital-First Banking

The rise of digital channels and the increasing preference for online and mobile banking are driving a shift towards digital-first banking. Banks are investing in digital platforms, mobile apps, and online banking solutions to provide seamless and convenient experiences for customers.

-

Digital Banking Trends:

- Mobile-first banking: Customers are increasingly using smartphones for their banking needs, demanding user-friendly mobile apps with advanced features.

- Personalized experiences: Banks are leveraging data to personalize digital banking experiences, offering tailored recommendations and services.

- Enhanced security: Digital banking platforms are incorporating advanced security features to protect customer data and prevent fraud.

5. The Importance of Cybersecurity and Data Privacy

As banks increasingly rely on technology and collect sensitive customer data, cybersecurity and data privacy become paramount. Banks must invest in robust security measures to protect customer information from cyber threats, comply with data privacy regulations, and build trust with customers.

-

Key Cybersecurity Considerations:

- Data encryption: Protecting customer data at rest and in transit through encryption techniques.

- Multi-factor authentication: Implementing strong authentication measures to prevent unauthorized access to accounts.

- Regular security audits: Conducting periodic security assessments to identify and address vulnerabilities.

6. The Growing Demand for Sustainable and Ethical Banking

Customers are increasingly concerned about the environmental and social impact of their financial choices. Banks are responding to this demand by offering sustainable investment options, supporting ethical businesses, and integrating environmental, social, and governance (ESG) factors into their operations.

-

Sustainable Banking Practices:

- ESG investing: Offering investment products that align with ESG principles, promoting responsible business practices.

- Green loans: Providing financing for environmentally friendly projects, such as renewable energy and energy efficiency.

- Philanthropic initiatives: Supporting charitable organizations and social causes through donations and volunteer programs.

7. The Impact of Regulatory Changes on the Banking Industry

The regulatory environment for banks is constantly evolving, with new regulations being introduced to address emerging risks and promote financial stability. Banks need to stay informed about regulatory changes and adapt their operations to comply with new requirements.

-

Key Regulatory Trends:

- Open banking regulations: Implementing open banking frameworks to facilitate data sharing and promote competition.

- Cybersecurity regulations: Enforcing stricter cybersecurity standards to protect customer data and prevent cyberattacks.

- Anti-money laundering (AML) regulations: Strengthening AML measures to combat financial crime and terrorism financing.

8. The Future of Banking: A Collaborative Ecosystem

The future of banking is likely to be characterized by collaboration between banks, fintechs, and other industry players. Partnerships and ecosystems will enable banks to access innovative technologies, expand their offerings, and deliver more personalized and value-added services to customers.

-

Key Collaboration Opportunities:

- Joint ventures: Banks and fintechs can collaborate on developing and launching new financial products and services.

- API integration: Banks can integrate with fintech APIs to access specialized functionalities and enhance their offerings.

- Data sharing agreements: Banks can share data with trusted partners to improve customer insights and develop more personalized services.

Related Searches

- Future of Banking: This search explores the long-term trends shaping the banking industry, including technological advancements, customer expectations, and regulatory changes.

- Digital Banking Trends: This search focuses on the growing adoption of digital banking channels, including mobile banking, online banking, and digital payments.

- Fintech Impact on Banking: This search examines the influence of fintech companies on the banking industry, including competition, innovation, and new business models.

- Open Banking Regulations: This search explores the implementation of open banking frameworks and their impact on data sharing, competition, and customer experience.

- AI in Banking: This search delves into the applications of artificial intelligence in banking, including customer service, fraud detection, and risk management.

- Cybersecurity in Banking: This search focuses on the importance of cybersecurity in the banking industry, including data protection, threat prevention, and compliance with regulations.

- Sustainable Banking: This search explores the growing demand for sustainable and ethical banking practices, including ESG investing, green loans, and philanthropic initiatives.

- Regulatory Changes in Banking: This search examines the impact of regulatory changes on the banking industry, including open banking, cybersecurity, and AML regulations.

FAQs

Q1: What are the biggest challenges facing the banking industry in 2025?

A1: The banking industry faces several challenges in 2025, including:

- Competition from fintechs: Fintech companies are offering innovative and customer-centric financial solutions, posing a significant challenge to traditional banks.

- Changing customer expectations: Customers are demanding more personalized, convenient, and digital-centric financial experiences.

- Cybersecurity threats: The increasing reliance on technology and the collection of sensitive customer data make banks vulnerable to cyberattacks.

- Regulatory changes: The regulatory environment is constantly evolving, requiring banks to adapt their operations to comply with new requirements.

Q2: How can banks prepare for the future of banking in 2025?

A2: Banks can prepare for the future of banking by:

- Embracing innovation: Adopting new technologies, such as AI, ML, and open banking, to enhance customer experience and improve efficiency.

- Focusing on customer needs: Understanding and meeting the evolving expectations of customers by providing personalized and digital-first services.

- Investing in cybersecurity: Implementing robust security measures to protect customer data and prevent cyber threats.

- Collaborating with fintechs: Partnering with fintech companies to access innovative technologies and expand their offerings.

Q3: What are the potential benefits of bank industry trends in 2025?

A3: The trends shaping the banking industry in 2025 offer several potential benefits, including:

- Improved customer experience: Customers will have access to more personalized, convenient, and digital-centric financial services.

- Increased innovation: The competition from fintechs and the adoption of new technologies will drive innovation in the banking industry.

- Enhanced financial inclusion: Open banking and digital banking can facilitate access to financial services for underserved populations.

- Greater financial stability: Regulatory changes and improved cybersecurity measures can contribute to a more stable and secure financial system.

Tips

- Embrace a customer-centric approach: Focus on understanding and meeting the evolving needs of customers by providing personalized and digital-first services.

- Invest in technology: Embrace new technologies, such as AI, ML, and open banking, to enhance efficiency, improve customer experience, and stay ahead of the competition.

- Collaborate with fintechs: Partner with fintech companies to access innovative technologies, expand your offerings, and stay competitive.

- Prioritize cybersecurity: Implement robust security measures to protect customer data and prevent cyber threats, building trust and ensuring compliance with regulations.

- Stay informed about regulatory changes: Keep abreast of evolving regulations and adapt your operations to comply with new requirements.

- Embrace sustainability: Integrate ESG factors into your operations and offer sustainable investment options to meet the growing demand for responsible banking.

Conclusion

The bank industry trends in 2025 are transforming the financial services landscape, demanding banks to adapt and embrace innovation to thrive in a rapidly evolving environment. By embracing new technologies, focusing on customer needs, and collaborating with fintechs, banks can navigate these trends and position themselves for success in the future. The future of banking is bright, characterized by greater customer engagement, increased innovation, and a more inclusive and sustainable financial system.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Evolving Landscape: Bank Industry Trends in 2025. We hope you find this article informative and beneficial. See you in our next article!