Navigating the Future: A Deep Dive into Trends Shaping Capital by 2025

Related Articles: Navigating the Future: A Deep Dive into Trends Shaping Capital by 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Future: A Deep Dive into Trends Shaping Capital by 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: A Deep Dive into Trends Shaping Capital by 2025

The landscape of capital is constantly evolving, driven by technological advancements, shifting demographics, and evolving global dynamics. Understanding the key trends capital 2025 is crucial for individuals and organizations alike, as it allows for informed decision-making and strategic positioning in a rapidly changing environment. This comprehensive exploration delves into the most impactful trends shaping the future of capital, providing insights into their potential implications and the opportunities they present.

The Rise of Sustainable Investing:

Sustainable investing, often referred to as ESG (Environmental, Social, and Governance) investing, has transcended a niche market to become a mainstream force. Investors are increasingly prioritizing companies that demonstrate a commitment to environmental sustainability, social responsibility, and strong corporate governance. This trend is driven by several factors, including:

- Growing awareness of climate change and its impact: The urgency of addressing climate change is driving investors to seek out companies actively reducing their environmental footprint.

- Shifting consumer preferences: Consumers are increasingly demanding products and services from companies with strong ethical and social values.

- Regulatory pressures: Governments worldwide are implementing policies that incentivize sustainable practices and penalize environmentally harmful activities.

The Impact of Artificial Intelligence (AI) on Capital Markets:

AI is rapidly transforming the financial industry, automating tasks, enhancing decision-making, and creating new opportunities. Key applications of AI in capital markets include:

- Algorithmic trading: AI-powered algorithms can execute trades at lightning speed, maximizing returns and minimizing risk.

- Fraud detection: AI can analyze large datasets to identify fraudulent activities, enhancing security and reducing losses.

- Credit risk assessment: AI models can assess creditworthiness more accurately and efficiently than traditional methods.

- Investment strategy optimization: AI can help investors develop personalized investment strategies based on individual risk tolerance and financial goals.

The Growing Influence of Fintech:

Fintech, or financial technology, is disrupting traditional financial institutions and creating new avenues for accessing capital. Key trends in fintech include:

- Digital banking: Fintech companies are offering innovative digital banking solutions, providing greater convenience and accessibility.

- Crowdfunding: Platforms like Kickstarter and Indiegogo allow individuals and businesses to raise capital directly from a large number of investors.

- Peer-to-peer lending: Fintech companies are facilitating lending between individuals and businesses, bypassing traditional financial institutions.

- Blockchain technology: Blockchain is revolutionizing financial transactions, offering enhanced security, transparency, and efficiency.

The Increasing Importance of Data Analytics:

Data analytics plays a crucial role in understanding market trends, identifying investment opportunities, and managing risk. Key applications of data analytics in capital markets include:

- Market research: Analyzing vast amounts of data to identify emerging trends and anticipate market movements.

- Portfolio management: Optimizing investment portfolios based on data-driven insights and risk assessments.

- Risk management: Identifying and mitigating potential risks through data analysis and predictive modeling.

- Customer segmentation: Understanding customer needs and preferences to develop targeted financial products and services.

The Rise of Alternative Investments:

Alternative investments, such as private equity, real estate, and hedge funds, are becoming increasingly popular as investors seek diversification and higher returns. Key trends in alternative investments include:

- Growing demand for alternative assets: Investors are seeking assets that offer diversification and potential for higher returns than traditional investments.

- Increased accessibility: The rise of alternative investment platforms makes it easier for individual investors to access these assets.

- Focus on impact investing: Investors are increasingly seeking alternative investments that generate both financial returns and positive social or environmental impact.

The Impact of Globalization and Geopolitical Shifts:

Globalization and geopolitical shifts continue to shape the flow of capital and investment opportunities. Key trends include:

- Emerging markets growth: Rapid economic growth in emerging markets offers attractive investment opportunities, but also presents challenges related to political instability and regulatory uncertainty.

- Global trade tensions: Trade wars and other geopolitical conflicts can create volatility in capital markets and impact investment decisions.

- Cross-border capital flows: The increasing movement of capital across borders creates new opportunities for investors, but also raises concerns about regulatory arbitrage and financial stability.

The Importance of Adaptability and Innovation:

The ever-changing landscape of capital requires adaptability and innovation. Organizations and individuals need to be prepared to embrace new technologies, adjust their strategies, and stay ahead of evolving trends. This includes:

- Investing in technology: Adopting new technologies such as AI, blockchain, and data analytics is crucial for staying competitive.

- Developing new business models: The rise of fintech and other disruptive forces necessitates the creation of new business models to meet changing customer needs.

- Building strong relationships: Developing strong relationships with investors, partners, and regulators is essential for navigating the complex and dynamic capital markets.

Related Searches: Trends Capital 2025

1. Future of Finance 2025:

The future of finance is intertwined with trends capital 2025. The industry is undergoing a digital transformation, with AI, blockchain, and other technologies playing a pivotal role. Fintech companies are disrupting traditional financial institutions, offering innovative solutions and expanding access to financial services. The focus on sustainability is also shaping the future of finance, with investors increasingly prioritizing ESG factors.

2. Financial Technology Trends 2025:

Fintech is a key driver of trends capital 2025, offering innovative solutions for financial services. Key trends include the rise of digital banking, crowdfunding, peer-to-peer lending, and blockchain technology. These innovations are improving financial inclusion, enhancing efficiency, and creating new opportunities for investors and businesses.

3. Investment Strategies for 2025:

Understanding trends capital 2025 is crucial for developing successful investment strategies. Investors need to consider factors such as sustainable investing, the rise of alternative investments, and the impact of AI and data analytics. Diversification, risk management, and adaptability are essential for navigating the complex and dynamic capital markets.

4. Impact Investing Trends 2025:

Impact investing is gaining momentum, driven by the growing awareness of social and environmental challenges. Investors are seeking opportunities to generate both financial returns and positive social or environmental impact. Key trends include the rise of impact bonds, sustainable infrastructure projects, and investments in renewable energy.

5. Global Investment Outlook 2025:

The global investment outlook is shaped by trends capital 2025, including the growth of emerging markets, geopolitical shifts, and the increasing importance of sustainability. Investors need to consider the risks and opportunities associated with these trends when making investment decisions.

6. Digital Assets and Cryptocurrencies 2025:

Digital assets and cryptocurrencies are gaining traction, presenting both opportunities and challenges. Blockchain technology is revolutionizing financial transactions, offering enhanced security, transparency, and efficiency. However, regulatory uncertainty and volatility remain key concerns for investors.

7. Regulatory Landscape for Capital Markets 2025:

The regulatory landscape for capital markets is evolving in response to trends capital 2025, including the rise of fintech, the increasing importance of sustainability, and the growth of digital assets. Regulators are working to ensure financial stability, protect investors, and promote innovation.

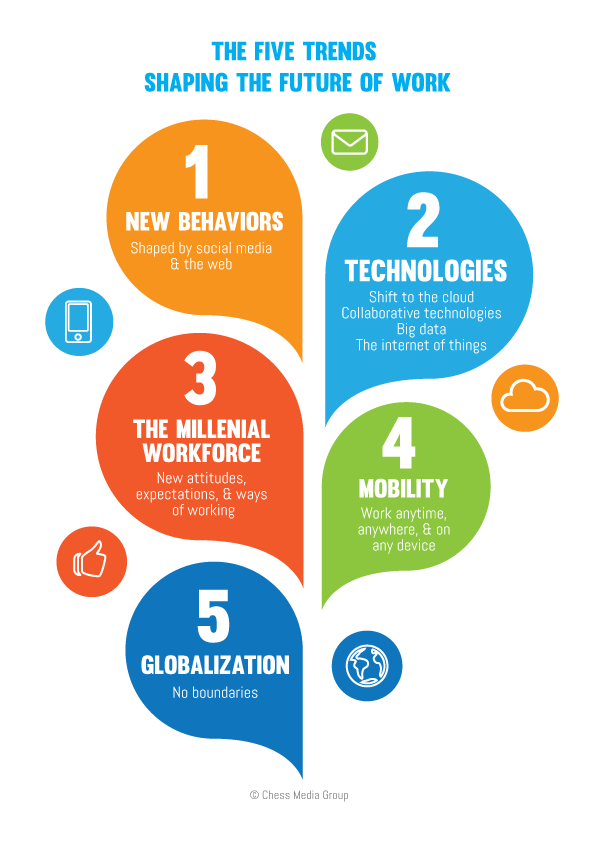

8. Future of Work in Finance 2025:

Trends capital 2025 are transforming the future of work in finance. AI, automation, and data analytics are automating tasks and changing the skillset required for financial professionals. The focus on sustainability and impact investing is also creating new job opportunities in areas like ESG analysis and impact measurement.

FAQs: Trends Capital 2025

Q: What are the key benefits of understanding trends capital 2025?

A: Understanding trends capital 2025 provides several benefits, including:

- Informed decision-making: It allows investors, businesses, and individuals to make informed decisions about investments, business strategies, and financial planning.

- Competitive advantage: Staying ahead of trends can give organizations a competitive advantage in attracting investors, accessing capital, and developing innovative products and services.

- Risk mitigation: Understanding potential risks associated with trends can help organizations mitigate risks and protect their investments.

- Opportunity identification: Recognizing emerging trends can lead to the identification of new investment opportunities and business models.

Q: How can individuals and organizations prepare for trends capital 2025?

A: Individuals and organizations can prepare for trends capital 2025 by:

- Investing in education and training: Staying informed about emerging trends and developing relevant skills is crucial.

- Adopting new technologies: Embracing technologies like AI, blockchain, and data analytics can enhance efficiency, create new opportunities, and stay competitive.

- Developing a sustainable mindset: Integrating ESG factors into investment decisions and business operations is becoming increasingly important.

- Building strong relationships: Cultivating relationships with investors, partners, and regulators is essential for navigating the complex and dynamic capital markets.

Q: What are the potential risks associated with trends capital 2025?

A: While trends capital 2025 offer significant opportunities, they also present potential risks, including:

- Cybersecurity threats: The increasing reliance on technology raises cybersecurity concerns, which could lead to data breaches and financial losses.

- Regulatory uncertainty: Rapid technological advancements and evolving market dynamics create regulatory uncertainty, which can impact investment decisions and business operations.

- Market volatility: Global economic and geopolitical uncertainties can create volatility in capital markets, leading to fluctuations in asset prices and investment returns.

- Social and environmental impact: The pursuit of financial returns can sometimes come at the expense of social and environmental considerations.

Tips: Trends Capital 2025

- Stay informed: Follow industry publications, attend conferences, and engage with experts to stay abreast of emerging trends.

- Embrace innovation: Be open to new technologies and business models that can enhance efficiency, create new opportunities, and improve financial performance.

- Consider ESG factors: Integrate environmental, social, and governance factors into investment decisions and business operations.

- Build strong relationships: Cultivate relationships with investors, partners, and regulators to navigate the complex and dynamic capital markets.

- Manage risk: Develop robust risk management strategies to mitigate potential risks associated with emerging trends.

Conclusion: Trends Capital 2025

Trends capital 2025 are shaping the future of capital, creating both opportunities and challenges. Understanding these trends is crucial for individuals and organizations alike, as it allows for informed decision-making, strategic positioning, and the ability to navigate the complex and dynamic capital markets. By embracing innovation, adapting to change, and prioritizing sustainability, individuals and organizations can position themselves for success in the evolving world of capital.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: A Deep Dive into Trends Shaping Capital by 2025. We thank you for taking the time to read this article. See you in our next article!