Navigating the Future: Accountancy Trends Shaping 2025

Related Articles: Navigating the Future: Accountancy Trends Shaping 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Future: Accountancy Trends Shaping 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Future: Accountancy Trends Shaping 2025

- 2 Introduction

- 3 Navigating the Future: Accountancy Trends Shaping 2025

- 3.1 The Rise of Automation and Artificial Intelligence

- 3.2 Data Analytics and Business Intelligence

- 3.3 Cloud Computing and Digital Transformation

- 3.4 Cybersecurity and Data Privacy

- 3.5 Blockchain and Distributed Ledger Technology

- 3.6 Sustainability Reporting and ESG (Environmental, Social, and Governance)

- 3.7 The Future of the Accounting Profession

- 3.8 Related Searches

- 3.9 FAQs

- 3.10 Tips

- 3.11 Conclusion

- 4 Closure

Navigating the Future: Accountancy Trends Shaping 2025

The accounting profession is undergoing a rapid transformation, driven by technological advancements, evolving business models, and a heightened demand for data-driven insights. While the core principles of accounting remain steadfast, the tools, methodologies, and skillsets required to navigate the complexities of the modern business landscape are evolving at an unprecedented pace. Accountancy trends 2025 will see a significant shift towards automation, data analytics, and a deeper integration with other business functions, creating a more dynamic and value-driven role for accountants.

This article delves into the key accountancy trends 2025 that will shape the future of the profession, exploring their implications for businesses and professionals alike. By understanding these trends, accountants can proactively prepare for the challenges and opportunities that lie ahead, ensuring their continued relevance and success in an ever-changing environment.

The Rise of Automation and Artificial Intelligence

Automation is rapidly transforming the accounting landscape, automating repetitive tasks and freeing up accountants to focus on higher-value activities. Artificial intelligence (AI) is playing a pivotal role in this transformation, enabling the automation of tasks such as data entry, invoice processing, and financial reporting.

Impact on Businesses:

- Increased Efficiency: Automation streamlines workflows, reducing manual errors and freeing up valuable time for strategic decision-making.

- Improved Accuracy: AI-powered systems can analyze vast amounts of data, identifying patterns and anomalies that might otherwise go unnoticed, leading to more accurate financial reporting.

- Enhanced Compliance: Automation ensures adherence to regulatory requirements, reducing the risk of non-compliance penalties.

Impact on Accountants:

- Shift in Focus: Accountants will need to develop skills in data analysis, interpretation, and strategic thinking to leverage the insights provided by automated systems.

- New Roles: The rise of automation will create new roles such as data analysts, automation specialists, and AI consultants within the accounting profession.

- Enhanced Value Proposition: By focusing on higher-value tasks, accountants can provide greater strategic guidance and support to businesses.

Data Analytics and Business Intelligence

Data is the lifeblood of modern businesses, and accountants are increasingly expected to harness its power to provide valuable insights. Accountancy trends 2025 will see a significant shift towards data analytics and business intelligence, enabling accountants to move beyond traditional financial reporting and contribute to strategic decision-making.

Impact on Businesses:

- Data-Driven Decision Making: By analyzing financial data alongside operational and market data, accountants can provide more comprehensive insights into business performance, enabling informed decision-making.

- Improved Forecasting: Data analytics tools can identify trends and patterns, enabling more accurate forecasting and planning.

- Enhanced Risk Management: Analyzing data can help businesses identify potential risks and opportunities, enabling proactive risk management strategies.

Impact on Accountants:

- Data Literacy: Accountants will need to develop strong data literacy skills, including data collection, analysis, visualization, and interpretation.

- Cross-Functional Collaboration: Data analytics will require collaboration with other departments, such as sales, marketing, and operations.

- Strategic Business Partner: Accountants will become more strategic business partners, providing data-driven insights that inform business decisions.

Cloud Computing and Digital Transformation

Cloud computing is rapidly transforming the way businesses operate, offering greater flexibility, scalability, and cost-effectiveness. Accountancy trends 2025 will see a widespread adoption of cloud-based accounting software, enabling real-time access to financial data and facilitating seamless collaboration across teams and locations.

Impact on Businesses:

- Increased Flexibility: Cloud-based accounting software can be accessed from any device with an internet connection, providing greater flexibility for employees working remotely or on the go.

- Improved Collaboration: Cloud platforms facilitate real-time collaboration on financial data, breaking down silos and enhancing communication.

- Reduced Costs: Cloud-based solutions eliminate the need for expensive hardware and software licenses, reducing IT costs.

Impact on Accountants:

- Digital Proficiency: Accountants will need to become proficient in using cloud-based accounting software and other digital tools.

- Remote Work Opportunities: Cloud computing enables remote work, opening up new opportunities for accountants to work from anywhere in the world.

- Increased Efficiency: Cloud-based solutions automate many accounting tasks, freeing up accountants to focus on strategic activities.

Cybersecurity and Data Privacy

As businesses become increasingly reliant on technology, cybersecurity and data privacy become paramount. Accountancy trends 2025 will see a heightened focus on protecting sensitive financial data from cyberattacks and ensuring compliance with data privacy regulations.

Impact on Businesses:

- Data Breaches: Cyberattacks can result in significant financial losses, reputational damage, and legal penalties.

- Compliance Risks: Failure to comply with data privacy regulations can lead to hefty fines and penalties.

- Customer Trust: Protecting customer data is essential for building and maintaining trust.

Impact on Accountants:

- Cybersecurity Awareness: Accountants need to be aware of the latest cybersecurity threats and best practices for protecting financial data.

- Data Privacy Compliance: Accountants will need to ensure compliance with evolving data privacy regulations, such as GDPR and CCPA.

- Risk Mitigation: Accountants will play a critical role in identifying and mitigating cybersecurity risks.

Blockchain and Distributed Ledger Technology

Blockchain technology, known for its secure and transparent nature, is gaining traction in the accounting industry. Accountancy trends 2025 will see an increasing adoption of blockchain for tasks such as financial auditing, supply chain management, and fraud detection.

Impact on Businesses:

- Improved Transparency: Blockchain provides an immutable record of transactions, enhancing transparency and accountability.

- Reduced Fraud: The decentralized nature of blockchain makes it difficult for fraudsters to manipulate data.

- Streamlined Processes: Blockchain can automate processes such as invoice reconciliation and payment processing.

Impact on Accountants:

- Blockchain Expertise: Accountants will need to develop expertise in blockchain technology and its applications in accounting.

- New Opportunities: Blockchain will create new roles and opportunities for accountants in areas such as blockchain auditing and consulting.

- Enhanced Efficiency: Blockchain can streamline accounting processes, reducing manual effort and improving efficiency.

Sustainability Reporting and ESG (Environmental, Social, and Governance)

Sustainability reporting and ESG (Environmental, Social, and Governance) considerations are becoming increasingly important for businesses. Accountancy trends 2025 will see a greater emphasis on integrating ESG factors into financial reporting and decision-making.

Impact on Businesses:

- Investor Pressure: Investors are increasingly demanding transparency on ESG issues, and businesses that fail to address these concerns may face reputational damage and financial penalties.

- Regulatory Requirements: Governments and regulatory bodies are introducing new regulations related to sustainability reporting.

- Competitive Advantage: Businesses that prioritize sustainability can attract investors, customers, and talent, gaining a competitive advantage.

Impact on Accountants:

- ESG Expertise: Accountants will need to develop expertise in ESG reporting frameworks and standards.

- Integrated Reporting: Accountants will play a key role in integrating ESG factors into financial reporting and decision-making.

- Sustainability Consulting: Accountants can provide consulting services to businesses on sustainability reporting and ESG issues.

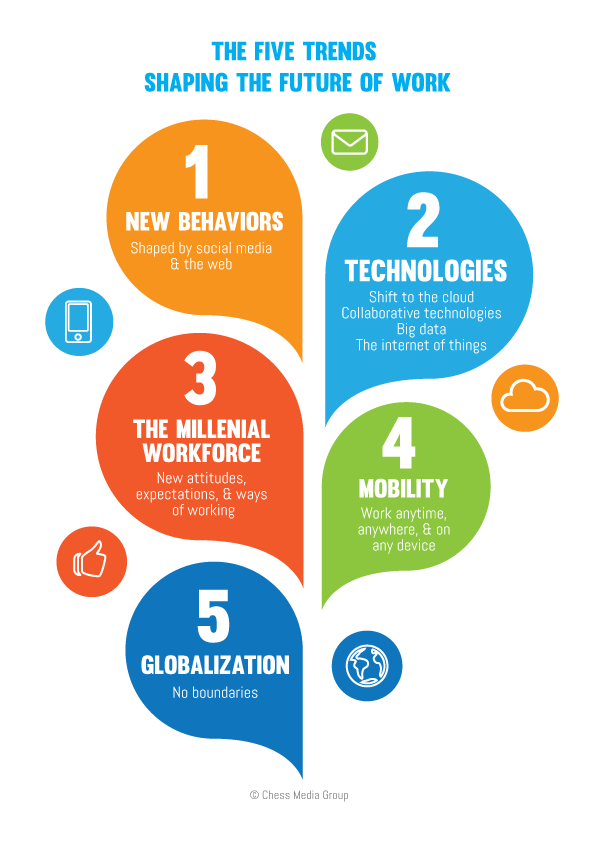

The Future of the Accounting Profession

Accountancy trends 2025 point towards a future where the accounting profession is more dynamic, data-driven, and value-driven. Accountants will need to embrace new technologies, develop new skills, and adopt a more strategic mindset to thrive in this evolving environment.

Key Skills for the Future:

- Data Analytics: Analyzing and interpreting data to provide actionable insights.

- Technology Proficiency: Mastering cloud-based accounting software and other digital tools.

- Communication and Collaboration: Effectively communicating with clients, colleagues, and stakeholders.

- Strategic Thinking: Providing strategic guidance and support to businesses.

- Adaptability and Continuous Learning: Keeping abreast of emerging technologies and trends.

Opportunities for Growth:

- Specialized Services: Accountants can specialize in areas such as data analytics, cybersecurity, blockchain, or ESG reporting.

- Cross-Functional Roles: Accountants can take on roles that integrate accounting with other business functions, such as operations, marketing, or sales.

- Entrepreneurship: Accountants can leverage their skills and knowledge to start their own accounting firms or consulting businesses.

The future of the accounting profession is bright for those who embrace change and adapt to the evolving landscape. By staying ahead of the curve and developing the skills and knowledge required to navigate the future, accountants can continue to play a vital role in the success of businesses and the global economy.

Related Searches

Accountancy trends 2025 is a broad topic, and there are many related searches that delve deeper into specific aspects of the trends discussed above. Here are some examples:

- Automation in Accounting: This search explores the specific ways automation is transforming accounting tasks, including data entry, invoice processing, and financial reporting.

- AI in Accounting: This search focuses on the role of artificial intelligence in accounting, covering topics such as AI-powered audit tools, fraud detection, and predictive analytics.

- Cloud Accounting Software: This search explores the benefits and challenges of using cloud-based accounting software, including popular platforms like Xero, QuickBooks Online, and NetSuite.

- Data Analytics for Accountants: This search delves into the importance of data analytics for accountants, covering topics such as data visualization, financial modeling, and business intelligence.

- Cybersecurity for Accountants: This search focuses on the cybersecurity risks facing accountants and businesses, covering topics such as data breaches, ransomware attacks, and best practices for protecting financial data.

- Blockchain in Accounting: This search explores the potential of blockchain technology for accounting, covering topics such as audit trails, supply chain management, and smart contracts.

- ESG Reporting for Accountants: This search delves into the importance of ESG reporting, covering topics such as sustainability frameworks, data collection, and reporting standards.

- Future of Accounting Careers: This search explores the job market for accountants in the future, covering topics such as emerging roles, skills in demand, and career paths.

FAQs

Q: What are the biggest challenges facing the accounting profession in 2025?

A: The biggest challenges facing the accounting profession in 2025 include:

- Keeping up with technological advancements: The rapid pace of technological change requires accountants to constantly learn new skills and adapt to new tools.

- Meeting evolving regulatory requirements: The accounting profession is subject to a constantly evolving regulatory landscape, requiring accountants to stay informed and compliant.

- Attracting and retaining talent: The accounting profession faces competition from other industries for skilled professionals, making it crucial to attract and retain talented individuals.

- Adapting to changing business models: The rise of digital businesses and the gig economy presents new challenges for accountants, requiring them to adapt their services to meet the needs of these businesses.

Q: How can accountants prepare for the changes ahead?

A: Accountants can prepare for the changes ahead by:

- Developing new skills: Investing in training and education to acquire skills in data analytics, technology, and communication.

- Embracing new technologies: Learning to use cloud-based accounting software, AI-powered tools, and other emerging technologies.

- Networking and staying informed: Attending industry events, reading industry publications, and connecting with other professionals to stay abreast of the latest trends.

- Focusing on value-added services: Shifting from traditional tasks to providing strategic guidance and insights to businesses.

Q: Will automation replace accountants?

A: While automation will automate many repetitive tasks, it is unlikely to replace accountants entirely. Instead, automation will free up accountants to focus on higher-value activities such as data analysis, strategic planning, and client relationships.

Q: What are the benefits of embracing accountancy trends 2025?

A: Embracing accountancy trends 2025 offers numerous benefits, including:

- Increased efficiency and productivity: Automation and cloud computing streamline workflows, reducing manual effort and improving efficiency.

- Improved accuracy and insights: Data analytics and AI-powered tools provide more accurate financial reporting and valuable insights for decision-making.

- Enhanced compliance and risk management: Automation and data analysis help businesses comply with regulations and identify potential risks.

- Greater value-added services: Accountants can offer more strategic and data-driven services to businesses, becoming more valuable business partners.

Tips

- Invest in continuous learning: Stay up-to-date on the latest technologies and trends by attending workshops, taking online courses, or reading industry publications.

- Embrace technology: Familiarize yourself with cloud-based accounting software, AI-powered tools, and other emerging technologies.

- Develop data analysis skills: Learn to collect, analyze, and interpret data to provide valuable insights to businesses.

- Network and build relationships: Connect with other professionals in the industry, attend industry events, and join professional organizations.

- Focus on value-added services: Offer strategic advice, data-driven insights, and consulting services to businesses.

Conclusion

Accountancy trends 2025 present both challenges and opportunities for the accounting profession. By embracing these trends, accountants can position themselves for success in a rapidly evolving environment. By developing new skills, adopting new technologies, and focusing on value-added services, accountants can continue to play a vital role in the success of businesses and the global economy.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Accountancy Trends Shaping 2025. We thank you for taking the time to read this article. See you in our next article!