Navigating the Future: Citi Trends Investor Relations in 2025

Related Articles: Navigating the Future: Citi Trends Investor Relations in 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Future: Citi Trends Investor Relations in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: Citi Trends Investor Relations in 2025

The retail landscape is dynamic, constantly evolving to meet changing consumer demands and economic shifts. For companies like Citi Trends, a leading value-oriented retailer catering to the African American and Hispanic communities, navigating this landscape requires a strategic approach to investor relations. Citi Trends Investor Relations in 2025 will be a critical element in the company’s journey towards sustained growth and profitability.

Understanding the Landscape:

The year 2025 presents both challenges and opportunities for Citi Trends. The retail sector is expected to continue its digital transformation, with online shopping gaining further traction. Consumers are increasingly seeking value and convenience, demanding personalized experiences and seamless omnichannel engagement. In this context, Citi Trends Investor Relations must play a key role in communicating the company’s strategic vision and demonstrating its ability to adapt to these evolving trends.

Strategic Pillars for Success:

To thrive in this dynamic environment, Citi Trends must focus on several key strategic pillars:

- Digital Transformation: Accelerating the company’s digital transformation will be paramount. This involves enhancing online shopping capabilities, optimizing the website and mobile app, and leveraging data analytics to personalize customer experiences.

- Omnichannel Integration: Seamlessly integrating online and offline channels is crucial. Citi Trends needs to offer a consistent and convenient shopping experience across all touchpoints, including in-store, online, and mobile.

- Data-Driven Decision Making: Leveraging data analytics to gain insights into customer behavior, market trends, and operational efficiency is essential for informed decision-making.

- Sustainability and Social Responsibility: Consumers increasingly prioritize companies with strong sustainability and social responsibility practices. Citi Trends must demonstrate its commitment to these values, fostering a positive brand image and attracting environmentally conscious investors.

- Financial Performance and Growth: Maintaining strong financial performance and demonstrating a clear growth strategy are crucial for attracting and retaining investors.

The Importance of Transparency and Communication:

Citi Trends Investor Relations plays a critical role in bridging the gap between the company and its investors. Effective communication is essential for fostering trust and confidence. This involves:

- Clear and Concise Disclosure: Providing investors with timely and accurate information about the company’s financial performance, strategic initiatives, and operational updates is crucial.

- Engaging Investor Relations Programs: Implementing proactive investor relations programs, such as investor conferences, roadshows, and webcasts, helps to build relationships with investors and provide them with valuable insights into the company’s vision and strategy.

- Active Stakeholder Engagement: Engaging with a wide range of stakeholders, including investors, analysts, and the media, is essential for building a strong reputation and ensuring the company’s message resonates with the broader market.

Related Searches and FAQs

Related Searches:

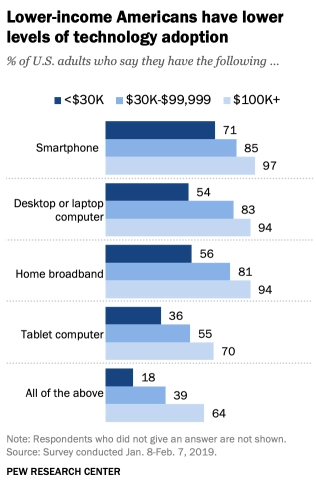

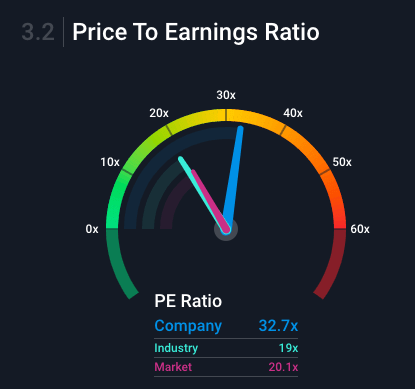

- Citi Trends Stock Price: Investors are naturally interested in the company’s stock performance, tracking its price fluctuations and analyzing its valuation.

- Citi Trends Financial Statements: Access to financial statements, including income statements, balance sheets, and cash flow statements, provides investors with a detailed picture of the company’s financial health.

- Citi Trends Analyst Ratings: Analyst ratings, which are based on their assessment of the company’s prospects, can provide investors with additional perspectives on the company’s valuation and future performance.

- Citi Trends Investor Relations Contact: Investors may need to contact the investor relations team for specific information, clarification, or to address concerns.

- Citi Trends Company Profile: A comprehensive company profile provides investors with essential information about Citi Trends, including its history, business model, target market, and competitive landscape.

- Citi Trends News and Events: Keeping up with company news and events, such as earnings releases, investor presentations, and industry conferences, allows investors to stay informed about the company’s latest developments.

- Citi Trends Sustainability Report: Investors increasingly seek information about companies’ sustainability practices. A sustainability report outlines the company’s environmental, social, and governance (ESG) initiatives.

- Citi Trends Corporate Governance: Good corporate governance practices are essential for building investor confidence. Investors may seek information about the company’s board of directors, management structure, and internal controls.

FAQs

Q: What is Citi Trends’ current financial performance?

A: Citi Trends’ financial performance can be assessed through its quarterly and annual earnings reports, which are publicly available on the company’s investor relations website. Investors can analyze key metrics such as revenue growth, profitability, and cash flow to understand the company’s financial health.

Q: What are Citi Trends’ key growth strategies?

A: Citi Trends’ growth strategies can be found in its investor presentations, annual reports, and press releases. These documents typically outline the company’s plans for expanding its store network, enhancing its digital capabilities, and diversifying its product offerings.

Q: How does Citi Trends address competition in the retail market?

A: Citi Trends competes with a wide range of retailers, including both brick-and-mortar and online players. The company differentiates itself through its focus on value, its understanding of the African American and Hispanic communities, and its commitment to providing a unique shopping experience.

Q: What are Citi Trends’ plans for sustainability and social responsibility?

A: Citi Trends’ sustainability and social responsibility initiatives are often outlined in its sustainability reports and other public disclosures. Investors can assess the company’s commitment to environmental protection, ethical sourcing, and community engagement.

Q: How can I contact Citi Trends Investor Relations?

A: Contact information for Citi Trends Investor Relations can be found on the company’s website. This typically includes phone numbers, email addresses, and mailing addresses.

Tips for Investors

- Stay informed: Regularly review Citi Trends’ investor relations website, press releases, and SEC filings to stay updated on the company’s performance and strategic initiatives.

- Attend investor events: Participate in investor conferences, roadshows, and webcasts to engage directly with company management and gain insights into their vision and strategy.

- Analyze financial data: Carefully examine Citi Trends’ financial statements and key performance indicators to assess the company’s financial health and growth prospects.

- Engage with analysts: Follow analyst ratings and reports on Citi Trends to gain diverse perspectives on the company’s valuation and future performance.

- Consider long-term value: Invest in Citi Trends based on a long-term perspective, considering the company’s potential for growth and its ability to adapt to changing market conditions.

Conclusion

Citi Trends Investor Relations in 2025 will be crucial for the company’s success. By effectively communicating its strategic vision, demonstrating its ability to adapt to evolving consumer demands, and fostering strong relationships with investors, Citi Trends can navigate the dynamic retail landscape and achieve sustainable growth. Transparency, proactive communication, and a commitment to stakeholder engagement will be key to building trust and confidence, attracting investment, and ultimately, driving value creation for all stakeholders.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Citi Trends Investor Relations in 2025. We hope you find this article informative and beneficial. See you in our next article!