Navigating the Future: Insurance Industry Trends in 2025

Related Articles: Navigating the Future: Insurance Industry Trends in 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Future: Insurance Industry Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: Insurance Industry Trends in 2025

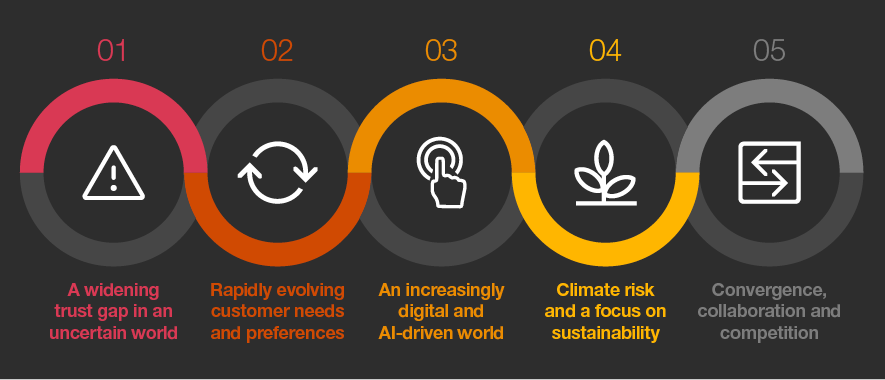

The insurance industry is undergoing a dramatic transformation, driven by technological advancements, evolving consumer expectations, and a rapidly changing global landscape. As we approach 2025, several key trends will shape the industry’s future, impacting how insurance is bought, sold, and delivered. Understanding these trends is crucial for insurers to remain competitive and relevant in the years to come.

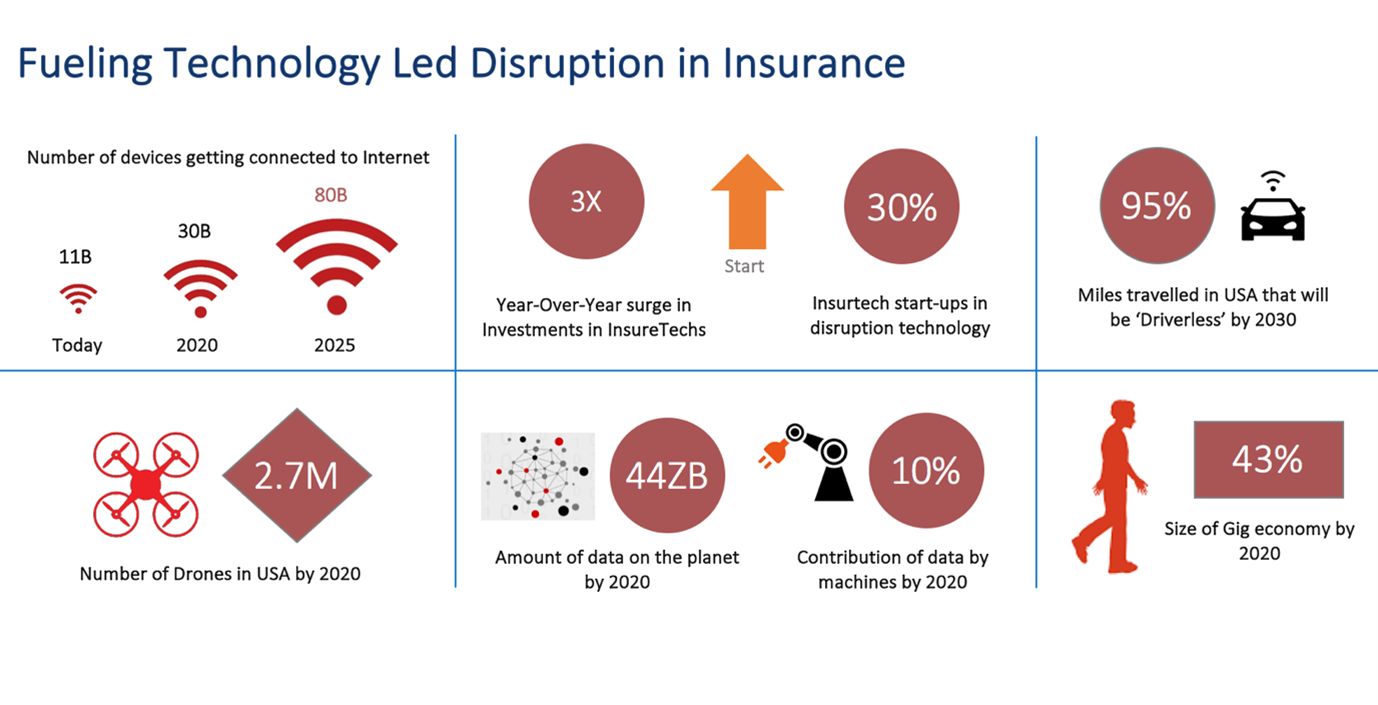

1. The Rise of Insurtech:

Insurtech refers to the application of technology to the insurance industry. It encompasses a wide range of innovations, including artificial intelligence (AI), blockchain, big data analytics, and mobile-first solutions. These technologies are fundamentally changing how insurers operate and interact with their customers.

a) AI-Powered Underwriting and Claims Processing:

AI algorithms are revolutionizing underwriting and claims processing, enabling faster, more accurate, and more personalized decision-making. AI-powered systems can analyze vast amounts of data to assess risk, identify fraud, and automate claims processing. This not only improves efficiency but also enhances customer experience by reducing wait times and simplifying the claims process.

b) Personalized Insurance Products and Pricing:

Insurtech allows insurers to gather and analyze individual data to offer customized insurance products and pricing. This data-driven approach enables insurers to develop more relevant and competitive offerings, catering to specific customer needs and risk profiles.

c) The Emergence of Digital Insurance Platforms:

Digital insurance platforms are gaining popularity, offering customers a seamless online experience for purchasing, managing, and claiming insurance. These platforms provide greater transparency, convenience, and control over insurance policies, attracting tech-savvy customers who value digital interactions.

2. The Growing Importance of Data and Analytics:

Data is becoming the lifeblood of the insurance industry. Insurers are increasingly leveraging data analytics to gain a deeper understanding of their customers, risks, and market trends. This data-driven approach enables them to make informed decisions, optimize pricing strategies, and develop innovative products.

a) Predictive Analytics for Risk Management:

Predictive analytics uses historical data and machine learning algorithms to forecast future events and identify potential risks. Insurers can utilize this technology to anticipate claims, optimize pricing, and manage risk more effectively.

b) Customer Segmentation and Targeting:

Data analytics allows insurers to segment their customer base based on demographics, behavior, and risk profiles. This enables them to tailor marketing campaigns and product offerings to specific customer segments, improving customer engagement and sales.

c) Fraud Detection and Prevention:

Advanced analytics tools can detect patterns and anomalies in claims data, helping insurers identify fraudulent claims and prevent financial losses. This improves the efficiency of claims processing and protects the insurer’s financial integrity.

3. The Shift Towards a Customer-Centric Approach:

The insurance industry is moving away from a product-centric approach and embracing a customer-centric mindset. This means prioritizing customer needs and expectations, offering personalized experiences, and providing seamless digital interactions.

a) Enhanced Customer Service and Support:

Insurers are investing in digital channels and self-service tools to provide customers with 24/7 access to information and support. Chatbots, virtual assistants, and online portals are enhancing customer experience and reducing reliance on traditional call centers.

b) Personalized Communication and Engagement:

Insurers are leveraging data and technology to personalize communication with customers. This includes sending targeted marketing messages, providing personalized recommendations, and offering proactive support based on individual needs.

c) Focus on Transparency and Trust:

Customers are demanding greater transparency and trust from insurers. Insurers are responding by providing clear and concise policy information, simplifying language, and offering easy-to-understand online resources.

4. The Rise of Embedded Insurance:

Embedded insurance involves integrating insurance products into existing platforms and services, making it more accessible and convenient for customers. This trend is driven by the growing demand for seamless digital experiences and the desire for on-demand insurance solutions.

a) Insurance Integrated into E-commerce Platforms:

Customers can purchase insurance directly within online shopping platforms, such as e-commerce websites and mobile apps. This eliminates the need for separate insurance brokers and streamlines the purchasing process.

b) Insurance Embedded in Technology Products and Services:

Insurance can be embedded in various technology products and services, such as ride-sharing apps, smart home devices, and connected car platforms. This provides customers with tailored insurance coverage that aligns with their specific needs and usage patterns.

c) The Growth of Micro-Insurance:

Micro-insurance offers smaller, short-term insurance policies for specific needs, such as travel insurance or mobile phone protection. These products are often purchased online and are designed to be affordable and accessible to a wider customer base.

5. The Growing Impact of Climate Change:

Climate change is posing significant challenges for the insurance industry, increasing the frequency and severity of natural disasters and impacting risk assessment and pricing. Insurers are adapting to these changes by developing new products and services to mitigate climate risks.

a) Climate-Resilient Insurance Products:

Insurers are developing innovative insurance products that address the specific risks posed by climate change, such as flood insurance, wildfire protection, and drought coverage. These products incorporate data and analytics to assess climate-related risks and provide tailored solutions.

b) Investing in Sustainable Practices:

Insurers are increasingly investing in sustainable practices, such as renewable energy and green building initiatives, to reduce their environmental footprint and mitigate the impact of climate change.

c) Advocating for Climate Change Mitigation:

Insurers are actively advocating for policies and initiatives that address climate change, working with governments and other stakeholders to promote sustainable development and reduce future risks.

6. The Importance of Cybersecurity:

Cybersecurity is becoming increasingly critical for the insurance industry as digital transformation exposes insurers to new cyber threats. Insurers must invest in robust cybersecurity measures to protect sensitive customer data and ensure the integrity of their operations.

a) Data Encryption and Access Control:

Insurers are implementing strong data encryption protocols and access controls to protect customer data from unauthorized access and cyberattacks.

b) Cybersecurity Awareness Training:

Training employees on cybersecurity best practices is essential to prevent human error and reduce the risk of cyberattacks.

c) Incident Response Plans:

Insurers need to have comprehensive incident response plans in place to handle cyberattacks effectively and minimize potential damage.

7. The Rise of the Gig Economy:

The gig economy is changing the way people work and impacting the insurance industry. Insurers are adapting to this trend by developing insurance products specifically designed for gig workers, freelancers, and independent contractors.

a) Gig Economy Insurance Products:

Insurers are offering insurance products that provide coverage for gig workers, including liability insurance, workers’ compensation, and health insurance.

b) Flexibility and On-Demand Coverage:

Gig workers require flexible and on-demand insurance solutions that can be adjusted based on their changing work schedules and needs.

c) Partnerships with Gig Platforms:

Insurers are partnering with gig platforms to offer insurance products directly to their users, providing a seamless and convenient experience.

8. The Growing Importance of Regulation and Compliance:

The insurance industry is subject to a complex regulatory environment, and regulatory changes are constantly evolving. Insurers must stay informed about new regulations and ensure compliance to avoid penalties and maintain customer trust.

a) Data Privacy Regulations:

Data privacy regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), are placing stricter requirements on how insurers collect, use, and protect customer data.

b) Cybersecurity Regulations:

Cybersecurity regulations, such as the New York Cybersecurity Requirements for Financial Services Companies, are requiring insurers to implement robust cybersecurity measures to protect customer data and systems.

c) Anti-Money Laundering (AML) Regulations:

Insurers are subject to AML regulations to prevent money laundering and other financial crimes. They must implement robust KYC (Know Your Customer) procedures and monitor transactions for suspicious activity.

Related Searches

- Insurance Technology Trends 2025: This search focuses on the specific technological advancements shaping the insurance industry, including AI, blockchain, and data analytics.

- Future of Insurance Industry: This search explores broader trends and predictions about the future of insurance, including the impact of emerging technologies and changing consumer behavior.

- Digital Insurance Trends 2025: This search emphasizes the growing importance of digital channels, online platforms, and mobile solutions in the insurance industry.

- Insurance Industry Innovations: This search highlights innovative products, services, and business models that are transforming the insurance landscape.

- Insurance Market Trends 2025: This search focuses on market trends, including growth opportunities, competitive landscape, and emerging insurance segments.

- Impact of Artificial Intelligence on Insurance: This search delves into the specific ways AI is changing the insurance industry, including underwriting, claims processing, and customer service.

- Blockchain in Insurance: This search explores the potential of blockchain technology to revolutionize insurance processes, such as claims management and policy administration.

- Customer Experience in Insurance: This search emphasizes the importance of providing excellent customer experiences in the insurance industry, including personalized interactions, digital convenience, and transparent communication.

FAQs

1. What are the most significant challenges facing the insurance industry in 2025?

The insurance industry faces several challenges, including:

- Staying ahead of technological advancements: Rapidly evolving technologies require insurers to invest in innovation and adapt to new business models.

- Meeting evolving customer expectations: Customers are demanding more personalized experiences, digital convenience, and transparent communication.

- Managing climate change risks: Climate change is increasing the frequency and severity of natural disasters, impacting risk assessment and pricing.

- Maintaining cybersecurity: The growing reliance on digital systems exposes insurers to new cyber threats, requiring robust cybersecurity measures.

- Navigating regulatory changes: The insurance industry is subject to a complex and evolving regulatory environment, requiring insurers to stay informed and compliant.

2. How can insurers prepare for the future of insurance?

Insurers can prepare for the future by:

- Investing in technology: Embracing insurtech solutions, including AI, blockchain, and data analytics, to improve efficiency, enhance customer experience, and develop innovative products.

- Adopting a customer-centric approach: Prioritizing customer needs and expectations, offering personalized experiences, and providing seamless digital interactions.

- Developing climate-resilient products and services: Adapting to the changing climate by offering insurance products that address climate-related risks and investing in sustainable practices.

- Strengthening cybersecurity: Implementing robust cybersecurity measures to protect sensitive customer data and ensure the integrity of operations.

- Staying informed about regulatory changes: Monitoring regulatory developments and ensuring compliance with new regulations.

3. What are the potential benefits of these insurance industry trends for customers?

Customers can benefit from these trends in several ways, including:

- More personalized and relevant insurance products: Insurers can offer customized products that meet specific customer needs and risk profiles.

- Improved customer experience: Digital platforms, AI-powered tools, and enhanced customer service provide a more convenient and efficient insurance experience.

- Faster and more efficient claims processing: AI and data analytics can streamline claims processing, reducing wait times and simplifying the process.

- Greater transparency and trust: Insurers are providing clear and concise policy information, simplifying language, and offering easy-to-understand online resources.

- Access to innovative and flexible insurance solutions: Embedded insurance and micro-insurance offer customers more convenient and affordable options.

Tips

- Embrace digital transformation: Invest in technology and digital platforms to enhance customer experience, improve efficiency, and develop innovative products.

- Focus on customer needs: Prioritize customer expectations and provide personalized experiences, transparent communication, and seamless digital interactions.

- Leverage data and analytics: Utilize data to gain insights into customer behavior, risk assessment, and market trends.

- Develop climate-resilient strategies: Adapt to the changing climate by offering insurance products that address climate-related risks and investing in sustainable practices.

- Strengthen cybersecurity: Implement robust cybersecurity measures to protect sensitive customer data and ensure the integrity of operations.

- Stay informed about regulations: Monitor regulatory developments and ensure compliance with new regulations to avoid penalties and maintain customer trust.

Conclusion

The insurance industry is undergoing a period of rapid transformation, driven by technological advancements, evolving consumer expectations, and a changing global landscape. The trends discussed above are shaping the future of insurance, impacting how insurance is bought, sold, and delivered. By embracing these trends, insurers can remain competitive, meet the needs of their customers, and navigate the challenges of a dynamic and complex industry. The insurance industry is evolving towards a more digital, data-driven, and customer-centric future, offering both opportunities and challenges for insurers and customers alike.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Insurance Industry Trends in 2025. We hope you find this article informative and beneficial. See you in our next article!