Navigating the Future of Payments: Trends Shaping the Industry in 2025

Related Articles: Navigating the Future of Payments: Trends Shaping the Industry in 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Future of Payments: Trends Shaping the Industry in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Future of Payments: Trends Shaping the Industry in 2025

- 2 Introduction

- 3 Navigating the Future of Payments: Trends Shaping the Industry in 2025

- 3.1 1. The Rise of Embedded Finance

- 3.2 2. The Continued Dominance of Mobile Payments

- 3.3 3. The Growth of Real-Time Payments

- 3.4 4. The Increasing Importance of Data Security and Privacy

- 3.5 5. The Rise of Open Banking and APIs

- 3.6 6. The Growing Adoption of Cryptocurrency and Digital Assets

- 3.7 7. The Importance of Financial Inclusion

- 3.8 8. The Impact of Artificial Intelligence (AI) and Machine Learning (ML)

- 3.9 Related Searches:

- 3.10 FAQs:

- 3.11 Tips for Businesses:

- 3.12 Conclusion:

- 4 Closure

Navigating the Future of Payments: Trends Shaping the Industry in 2025

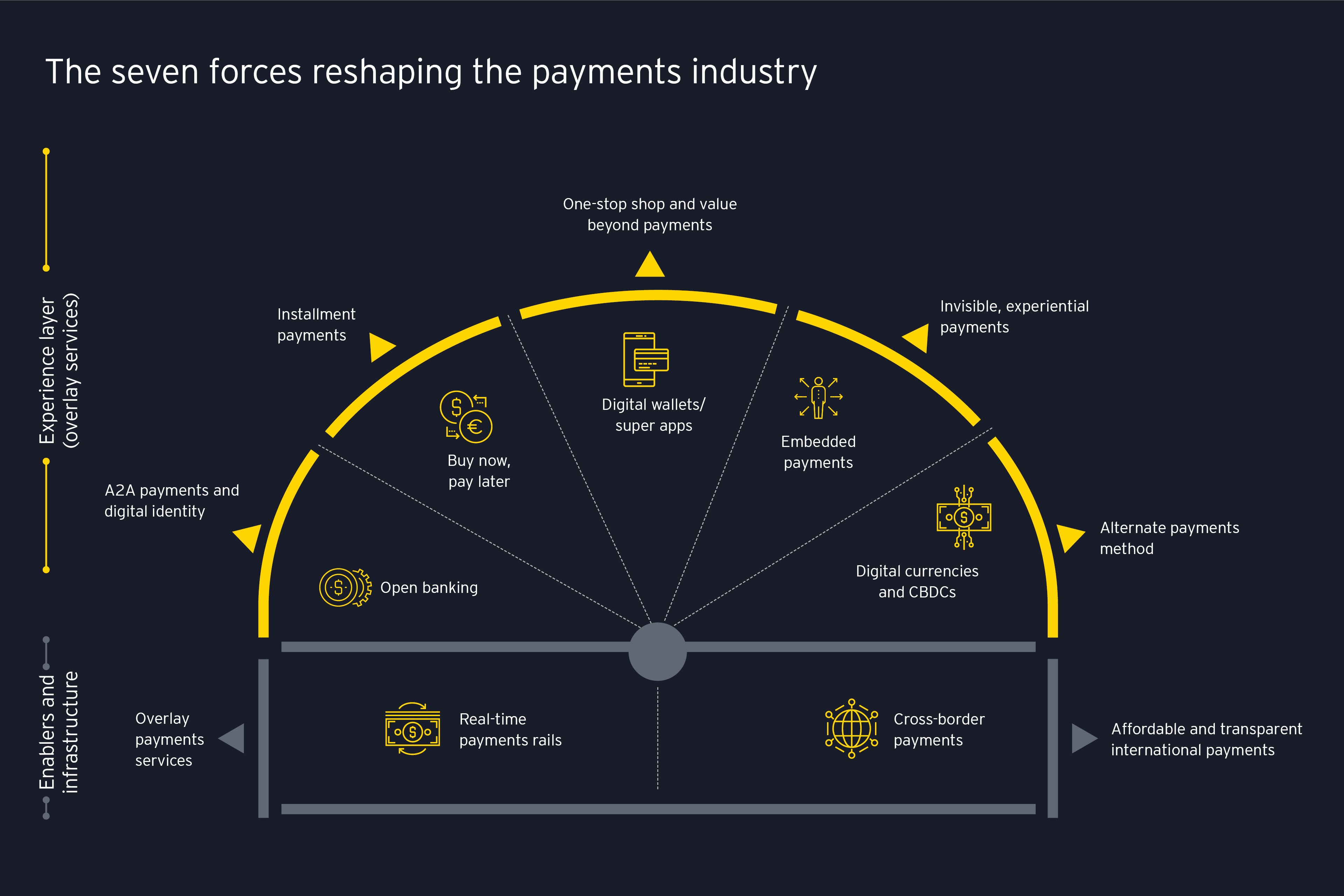

The payments industry is in a constant state of evolution, driven by technological advancements, shifting consumer preferences, and the emergence of new business models. As we approach 2025, several key trends are poised to reshape the landscape of how we pay and receive money. Understanding these trends is crucial for businesses and individuals alike, as they present both opportunities and challenges for navigating the future of payments.

Payments Industry Trends 2025 are not merely a collection of technological advancements; they represent a fundamental shift in how we interact with money, driven by increasing digitalization, a demand for seamless and secure experiences, and a focus on personalization and inclusivity.

1. The Rise of Embedded Finance

Embedded finance, also known as "fintech as a service," is a powerful trend that seamlessly integrates financial services into non-financial platforms. Imagine booking a flight and securing travel insurance through the same platform, or purchasing a product online and accessing a buy-now-pay-later option at checkout.

This integration eliminates the need for customers to navigate separate financial applications, creating a frictionless and convenient experience. Businesses across various sectors are embracing embedded finance, offering financial services like payments, lending, and insurance directly within their existing platforms. This trend is particularly significant for industries like e-commerce, travel, and healthcare, where financial transactions are often an integral part of the customer journey.

Benefits of Embedded Finance:

- Enhanced customer experience: Streamlined transactions and access to relevant financial services within existing platforms.

- Increased revenue streams: Businesses can offer new financial products and services, diversifying their revenue sources.

- Improved customer loyalty: Convenience and value-added services foster customer loyalty and retention.

Examples:

- E-commerce: Offering buy-now-pay-later options at checkout.

- Ride-hailing: Providing insurance options within the app.

- Travel platforms: Integrating travel insurance and currency exchange services.

2. The Continued Dominance of Mobile Payments

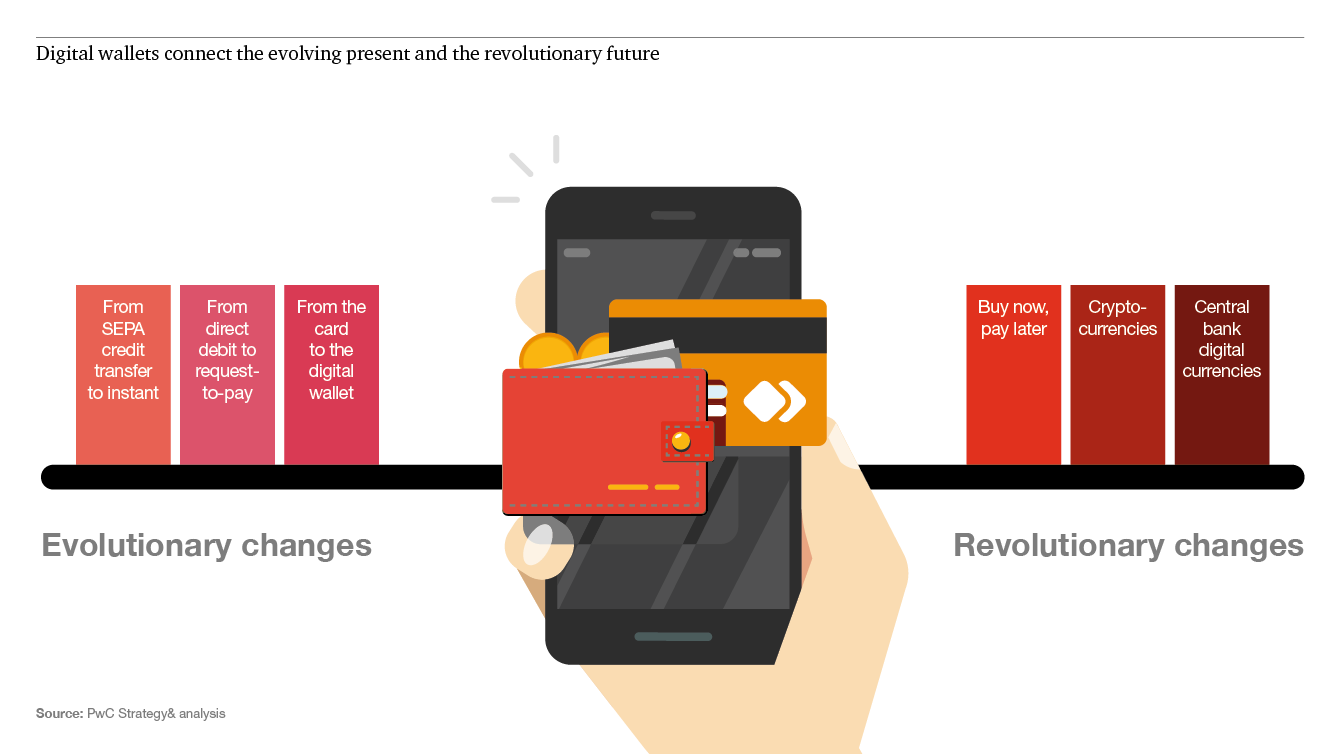

Mobile payments have already revolutionized the way we pay for goods and services, and this trend is set to continue its dominance in the coming years. The increasing adoption of smartphones, coupled with the convenience and security of mobile payment solutions, has driven the rapid growth of this sector.

Mobile wallets, such as Apple Pay, Google Pay, and Samsung Pay, offer a seamless and secure way to make payments, eliminating the need for physical cards. The rise of QR code-based payments, particularly in emerging markets, further reinforces the convenience and accessibility of mobile payments.

Benefits of Mobile Payments:

- Convenience: Easy and fast transactions through smartphones.

- Security: Secure payment methods with advanced encryption and authentication.

- Accessibility: Wide availability and acceptance across various merchants.

Examples:

- Contactless payments: Using smartphones or wearable devices to make purchases at physical stores.

- QR code payments: Scanning QR codes to initiate payments at restaurants, retail stores, and online platforms.

- Mobile wallets: Storing and managing multiple payment cards within a single app.

3. The Growth of Real-Time Payments

Real-time payments are transforming the speed and efficiency of financial transactions, enabling instant transfer of funds between accounts. This trend is driven by the increasing demand for speed and transparency in financial transactions.

Real-time payment systems, such as Zelle and Faster Payments, allow individuals and businesses to send and receive money instantly, eliminating the delays associated with traditional bank transfers. This instant transfer of funds has significant implications for businesses, enabling faster reconciliation, improved cash flow management, and enhanced customer satisfaction.

Benefits of Real-Time Payments:

- Speed: Instant transfer of funds, eliminating delays.

- Transparency: Real-time tracking of transactions.

- Improved cash flow: Faster reconciliation and reduced payment processing times.

Examples:

- Peer-to-peer (P2P) payments: Sending and receiving money instantly between individuals.

- Business-to-business (B2B) payments: Streamlining payments between businesses.

- Cross-border payments: Facilitating faster and more efficient international transactions.

4. The Increasing Importance of Data Security and Privacy

As the payments landscape becomes increasingly digital, data security and privacy are paramount. Consumers are becoming more aware of the potential risks associated with sharing their financial information online, demanding robust security measures from payment providers.

This trend is driving the development of innovative security technologies, such as biometrics, tokenization, and encryption, to protect sensitive data. Payment processors and financial institutions are investing heavily in cybersecurity infrastructure and compliance with regulatory standards to ensure the safety of customer data.

Benefits of Strong Security Measures:

- Reduced risk of fraud: Secure payment methods protect against unauthorized transactions.

- Enhanced customer trust: Building confidence in the safety of financial information.

- Compliance with regulations: Adhering to industry standards and regulatory requirements for data protection.

Examples:

- Biometric authentication: Using fingerprint, facial recognition, or voice recognition to verify identity.

- Tokenization: Replacing sensitive card data with unique tokens for secure transactions.

- Encryption: Protecting data during transmission and storage.

5. The Rise of Open Banking and APIs

Open banking is transforming the financial landscape by enabling third-party applications to access and utilize financial data with the customer’s consent. This trend is driven by the increasing demand for personalized financial services and the desire for greater control over financial data.

Open banking APIs (Application Programming Interfaces) allow developers to build innovative financial applications that leverage real-time data from bank accounts, enabling features like budgeting, financial planning, and personalized recommendations. This trend is empowering consumers and businesses alike by providing access to a wider range of financial services and tools.

Benefits of Open Banking:

- Increased competition and innovation: Fostering the development of new financial services and applications.

- Personalized financial management: Tailored solutions based on individual financial data.

- Enhanced customer control: Providing greater transparency and access to financial data.

Examples:

- Personal finance management apps: Aggregating and analyzing financial data from multiple accounts.

- Financial planning tools: Providing personalized recommendations based on spending patterns.

- Credit scoring and lending platforms: Leveraging financial data to assess creditworthiness.

6. The Growing Adoption of Cryptocurrency and Digital Assets

Cryptocurrency and digital assets are gaining significant traction in the payments industry, offering alternative payment methods with unique features. While still in its early stages, the use of cryptocurrencies for payments is expected to grow significantly in the coming years.

Cryptocurrencies like Bitcoin and Ethereum offer decentralized and secure payment solutions, enabling fast and efficient transactions without the need for intermediaries. Digital assets, including stablecoins and non-fungible tokens (NFTs), are also emerging as potential payment methods, offering greater flexibility and programmability.

Benefits of Cryptocurrency and Digital Assets:

- Decentralization: Removing reliance on traditional financial institutions.

- Security: Secure transactions through cryptography and blockchain technology.

- Transparency: Publicly auditable transaction history on the blockchain.

Examples:

- Cryptocurrency wallets: Storing and managing cryptocurrencies for payments.

- Merchant acceptance: Businesses accepting cryptocurrencies as payment for goods and services.

- Decentralized finance (DeFi): Utilizing blockchain technology for lending, borrowing, and other financial services.

7. The Importance of Financial Inclusion

Financial inclusion is becoming increasingly important in the payments industry, with a focus on providing access to financial services for underserved populations. This trend is driven by the recognition that financial services are essential for economic empowerment and social mobility.

Payment providers are developing innovative solutions, such as mobile money platforms and digital wallets, to reach unbanked and underbanked individuals, enabling them to participate in the formal financial system. This trend is crucial for promoting financial inclusion and fostering economic growth.

Benefits of Financial Inclusion:

- Economic empowerment: Providing access to financial services for underserved populations.

- Reduced poverty: Enabling individuals to manage their finances effectively.

- Improved financial literacy: Promoting education and awareness about financial products and services.

Examples:

- Mobile money platforms: Providing financial services through mobile phones.

- Digital wallets: Offering convenient and accessible payment solutions for unbanked individuals.

- Financial literacy programs: Educating individuals about financial concepts and tools.

8. The Impact of Artificial Intelligence (AI) and Machine Learning (ML)

Artificial intelligence (AI) and machine learning (ML) are transforming the payments industry, enabling more personalized and efficient experiences. AI-powered solutions are being used for fraud detection, risk management, and customer service, while ML algorithms are used to analyze data and provide personalized recommendations.

AI and ML are also driving the development of new payment methods, such as voice-activated payments and biometrics-based authentication, creating a more seamless and intuitive user experience.

Benefits of AI and ML:

- Improved fraud detection: Identifying and preventing fraudulent transactions.

- Enhanced risk management: Assessing customer risk and providing personalized solutions.

- Personalized recommendations: Offering tailored financial products and services.

Examples:

- Fraud prevention: Using AI algorithms to detect suspicious transactions.

- Customer service chatbots: Providing automated support and assistance.

- Personalized financial advice: Offering recommendations based on spending patterns and financial goals.

Related Searches:

- Payments Industry Trends 2023: Understanding the current trends in the payments industry is crucial for businesses and individuals alike. This search will provide insights into the latest developments and innovations that are shaping the industry.

- Future of Payments: This search explores the long-term trends and predictions for the payments industry, providing a vision of how payments will evolve in the coming years.

- Digital Payments Trends: This search focuses specifically on the trends shaping the digital payments landscape, including mobile payments, online payments, and contactless payments.

- Emerging Payment Technologies: This search delves into the latest technological advancements in the payments industry, such as blockchain, biometrics, and AI.

- Fintech Trends: This search explores the broader fintech landscape, encompassing trends related to payments, lending, investment, and other financial services.

- Payments Industry Statistics: This search provides data and statistics on the current state of the payments industry, including market size, growth rates, and adoption trends.

- Payments Industry Regulations: This search focuses on the regulatory landscape of the payments industry, including compliance requirements and emerging regulations.

- Payments Industry Challenges: This search explores the challenges faced by businesses and individuals in the payments industry, such as fraud, security, and regulatory compliance.

FAQs:

Q: What are the biggest challenges facing the payments industry in 2025?

A: The payments industry faces numerous challenges in 2025, including:

- Data security and privacy: Protecting sensitive financial information from cyber threats.

- Regulatory compliance: Navigating evolving regulations and industry standards.

- Keeping up with technological advancements: Adapting to new technologies and staying ahead of the competition.

- Meeting the needs of diverse customer segments: Catering to the evolving preferences and needs of different customer groups.

Q: How can businesses prepare for the payments industry trends of 2025?

A: Businesses can prepare for the future of payments by:

- Investing in technology: Adopting new technologies like mobile payments, real-time payments, and open banking.

- Prioritizing data security: Implementing robust security measures to protect customer data.

- Embracing innovation: Exploring new payment methods and solutions to meet evolving customer needs.

- Staying informed about industry trends: Monitoring the latest developments and adapting their strategies accordingly.

Q: What are the potential benefits of these trends for consumers?

A: Consumers stand to benefit from these trends in several ways:

- Enhanced convenience: Easier and faster ways to make payments.

- Increased security: More secure payment methods to protect financial information.

- Personalized experiences: Tailored financial services and recommendations.

- Greater access to financial services: Expanding financial inclusion and providing access to essential services.

Tips for Businesses:

- Embrace digitalization: Invest in digital payment solutions and technologies.

- Prioritize customer experience: Offer seamless and convenient payment options.

- Focus on data security: Implement robust security measures to protect sensitive data.

- Stay informed about industry trends: Monitor developments and adapt your strategies accordingly.

- Explore emerging technologies: Investigate the potential of technologies like AI, blockchain, and biometrics.

Conclusion:

The payments industry is on the cusp of significant transformation, driven by technological advancements, evolving customer expectations, and a focus on inclusivity. Understanding the trends shaping the industry is crucial for businesses and individuals alike, as it presents both opportunities and challenges for navigating the future of payments. By embracing innovation, prioritizing security, and focusing on customer needs, businesses can thrive in this dynamic landscape and contribute to a more efficient, secure, and inclusive financial ecosystem.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future of Payments: Trends Shaping the Industry in 2025. We thank you for taking the time to read this article. See you in our next article!