Navigating the Future: Trends Shaping the Insurance Landscape in 2025

Related Articles: Navigating the Future: Trends Shaping the Insurance Landscape in 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Future: Trends Shaping the Insurance Landscape in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: Trends Shaping the Insurance Landscape in 2025

The insurance industry is on the cusp of a significant transformation, driven by technological advancements, evolving customer expectations, and a shifting global landscape. By 2025, the industry will be unrecognizable from its current state, with new models, services, and technologies reshaping the way individuals and businesses manage risk. This article delves into the key trends in insurance 2025, exploring their impact and implications for stakeholders.

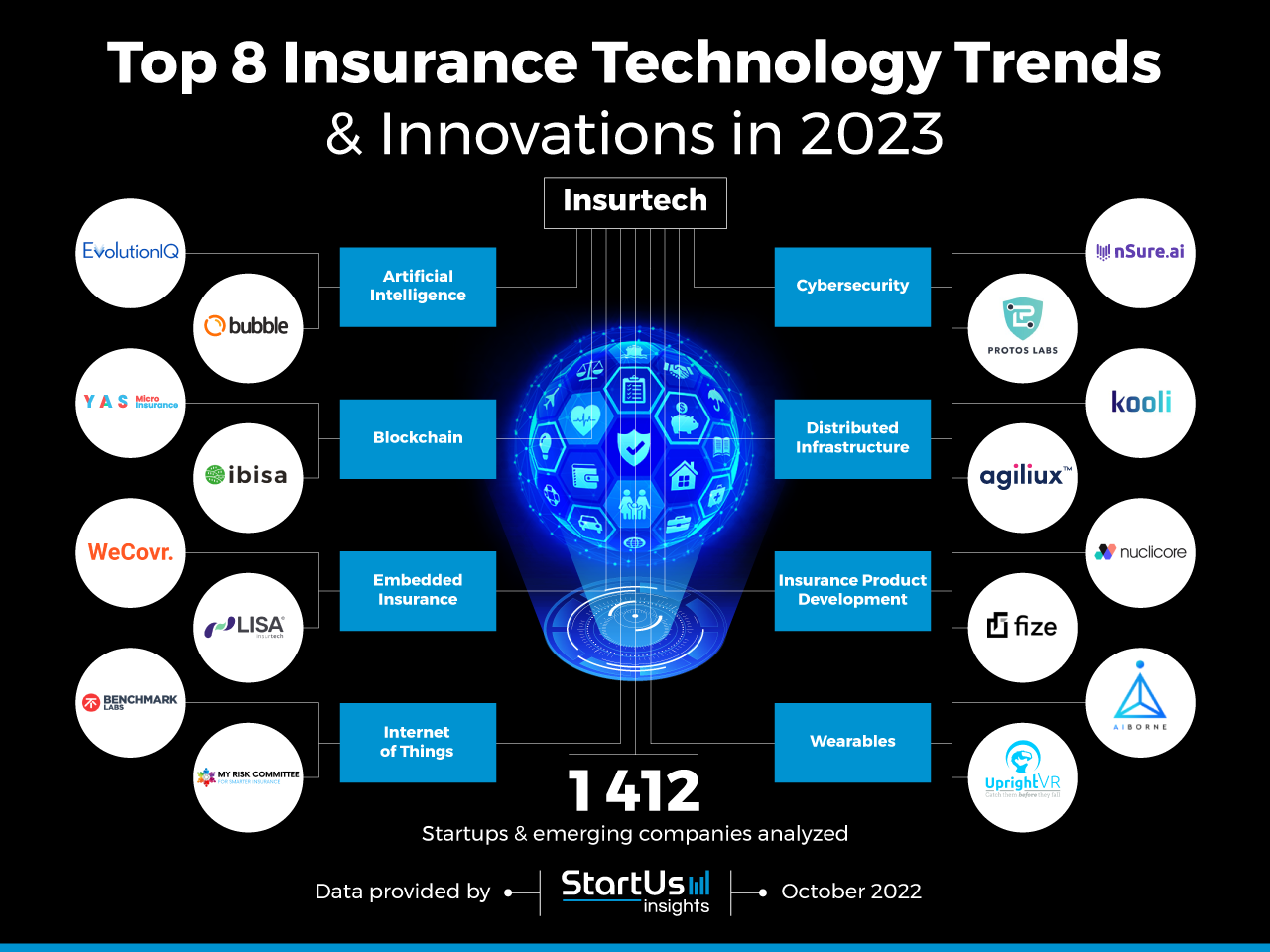

1. The Rise of Insurtech and Digital Transformation

Insurtech, the intersection of insurance and technology, is rapidly revolutionizing the industry. From AI-powered risk assessment and chatbot-driven customer service to blockchain-based claims processing and data-driven pricing models, insurtech solutions are streamlining operations, enhancing efficiency, and personalizing customer experiences.

- Artificial Intelligence (AI): AI is transforming underwriting, claims processing, and fraud detection. Algorithms analyze vast amounts of data to assess risk profiles, predict claims, and identify fraudulent activities, leading to faster and more accurate decision-making.

- Internet of Things (IoT): Connected devices are generating real-time data that can be used to personalize insurance policies and risk assessment. For example, telematics devices in cars provide insights into driving behavior, enabling insurers to offer tailored premiums based on individual driving patterns.

- Blockchain Technology: Blockchain offers a secure and transparent platform for managing insurance policies, claims processing, and payment transactions. It eliminates intermediaries, reduces administrative costs, and enhances trust and transparency throughout the value chain.

2. Personalized and On-Demand Insurance

Customers are increasingly demanding personalized and on-demand insurance solutions tailored to their specific needs. This trend is driving the development of flexible, modular insurance products that allow individuals to choose coverage components based on their individual risk profiles and preferences.

- Micro-insurance: Micro-insurance products offer affordable and accessible coverage for specific risks, such as mobile phone damage, travel insurance for short trips, or temporary health insurance. These bite-sized policies cater to the needs of individuals who may not require comprehensive coverage.

- Pay-per-use insurance: This model allows customers to pay only for the coverage they use, such as paying for mileage-based car insurance or usage-based home insurance. This approach offers flexibility and cost-effectiveness, appealing to individuals with varying risk profiles.

- Data-driven personalization: Insurers are leveraging customer data to tailor policies and pricing based on individual needs and preferences. This personalized approach enhances customer satisfaction and fosters loyalty.

3. The Growing Importance of Data and Analytics

Data analytics is becoming increasingly crucial for insurers to understand customer behavior, assess risk, and develop innovative products and services. By leveraging advanced analytics tools, insurers can gain valuable insights from vast datasets, enabling them to make data-driven decisions and optimize their operations.

- Predictive analytics: Insurers are using predictive models to identify potential risks, predict claims, and proactively manage policyholders’ needs. This approach allows for more efficient resource allocation and proactive risk mitigation.

- Customer segmentation: By analyzing customer data, insurers can segment their customer base into distinct groups with shared characteristics. This enables them to develop targeted marketing campaigns, personalize product offerings, and optimize customer service strategies.

- Real-time data analysis: Real-time data analysis allows insurers to monitor risk profiles and adjust premiums dynamically based on changing circumstances. This approach ensures that premiums reflect current risk levels, promoting fairness and transparency.

4. The Rise of Embedded Insurance

Embedded insurance integrates insurance products into existing platforms and services, offering seamless and convenient coverage options to consumers. This trend is driven by the increasing demand for convenient and integrated solutions, particularly among younger generations.

- E-commerce platforms: Insurance products are being integrated into online marketplaces and shopping platforms, allowing customers to purchase coverage directly during the purchase process. This eliminates the need for separate insurance applications, simplifying the process and enhancing convenience.

- Ride-sharing and delivery services: Embedded insurance is being offered within ride-sharing platforms and delivery services, providing on-demand coverage for passengers and drivers or goods in transit. This approach offers immediate protection and eliminates the need for separate insurance policies.

- Fintech partnerships: Insurers are collaborating with fintech companies to integrate insurance products into their platforms, offering seamless access to coverage for various financial services, such as loans, mortgages, and investments.

5. The Growing Impact of Climate Change

Climate change is posing significant challenges for the insurance industry, as extreme weather events become more frequent and severe. Insurers are adapting their risk assessment and pricing models to account for the growing risks associated with climate change.

- Natural disaster modeling: Insurers are using advanced modeling techniques to assess the potential impact of climate change on their portfolio and adjust pricing accordingly. This proactive approach ensures that premiums reflect the evolving risk landscape.

- Climate-resilient products: Insurers are developing new products and services that address the specific risks associated with climate change, such as flood insurance, drought insurance, and renewable energy insurance. These products offer protection against the growing impacts of climate change.

- Sustainable investments: Insurers are increasingly investing in sustainable projects and businesses that contribute to climate change mitigation and adaptation. This approach aligns with the growing demand for environmentally responsible investments and promotes a more sustainable future.

6. Focus on Customer Experience and Digital Engagement

Customer experience is becoming a key differentiator in the insurance industry. Insurers are investing in digital technologies to enhance customer engagement, provide seamless interactions, and deliver personalized services.

- Digital customer portals: Online portals provide customers with convenient access to policy information, claims processing, and customer support services. These portals streamline interactions and improve customer satisfaction.

- Mobile apps: Mobile apps offer on-the-go access to insurance services, allowing customers to manage their policies, file claims, and contact customer support directly from their smartphones. This mobile-first approach enhances convenience and accessibility.

- Personalized communication: Insurers are leveraging data analytics to personalize communication with customers, providing relevant information and tailored recommendations. This approach fosters stronger customer relationships and increases engagement.

7. The Rise of New Business Models and Partnerships

The insurance industry is witnessing the emergence of new business models and partnerships that leverage technology and innovation to disrupt traditional practices. These models are driven by the need to adapt to evolving customer needs and market dynamics.

- Insurtech startups: Insurtech startups are challenging established players with innovative solutions, disrupting traditional insurance models and introducing new approaches to risk assessment, pricing, and customer service.

- Strategic partnerships: Insurers are forming strategic partnerships with other industry players, such as fintech companies, technology providers, and data analytics experts, to leverage their expertise and expand their reach.

- Open insurance: Open insurance promotes data sharing and interoperability between insurers, allowing customers to access and manage their insurance policies across different platforms. This approach enhances transparency, empowers customers, and fosters innovation.

8. Regulatory Changes and Compliance

The insurance industry is subject to evolving regulations and compliance requirements, driven by factors such as data privacy, cybersecurity, and financial stability. Insurers must adapt their operations and systems to comply with these changing regulations.

- GDPR and data privacy: The General Data Protection Regulation (GDPR) and other data privacy laws require insurers to protect customer data and ensure transparency in data processing.

- Cybersecurity regulations: Insurers are increasingly targeted by cyberattacks, leading to the implementation of stricter cybersecurity regulations to protect sensitive customer data and prevent breaches.

- Financial stability regulations: Regulatory bodies are implementing stricter financial stability regulations to ensure that insurers have sufficient capital reserves and risk management practices in place to withstand economic shocks and market volatility.

Related Searches:

- Future of Insurance

- Insurance Trends 2023

- Insurance Industry Innovations

- Digital Insurance Trends

- Impact of Technology on Insurance

- Insurance Industry Disruption

- Insurtech Companies

- Insurance Market Analysis

FAQs on Trends in Insurance 2025:

Q: What are the key benefits of insurtech for the insurance industry?

A: Insurtech offers numerous benefits, including:

- Improved efficiency: Automating processes through AI and other technologies reduces administrative costs and improves operational efficiency.

- Enhanced customer experience: Personalized services, chatbot support, and seamless digital interactions enhance customer satisfaction and loyalty.

- Data-driven decision-making: Analytics and data insights enable insurers to make informed decisions regarding risk assessment, pricing, and product development.

- Innovation and new product development: Insurtech fosters innovation, enabling insurers to create new products and services that cater to evolving customer needs.

Q: How will climate change impact the insurance industry?

A: Climate change poses significant challenges for insurers, including:

- Increased risk of natural disasters: More frequent and severe extreme weather events will lead to higher claims costs and potential financial instability.

- Shifting risk profiles: Climate change alters risk profiles, requiring insurers to adjust their pricing models and risk assessment strategies.

- New product development: Insurers are developing new products and services to address the specific risks associated with climate change, such as flood insurance and renewable energy insurance.

- Investment in sustainability: Insurers are increasingly investing in sustainable projects and businesses to mitigate climate change and promote a more sustainable future.

Q: What are the key challenges facing the insurance industry in 2025?

A: The insurance industry faces several challenges, including:

- Adapting to rapid technological advancements: Keeping pace with the rapid evolution of technology requires significant investments in infrastructure, training, and new skills.

- Meeting evolving customer expectations: Customers demand personalized, on-demand, and seamless insurance solutions, requiring insurers to adapt their products and services accordingly.

- Managing cyber risks: Protecting sensitive customer data and systems from cyberattacks requires robust cybersecurity measures and ongoing vigilance.

- Addressing the impact of climate change: Adapting to the growing risks associated with climate change requires innovative risk assessment models, product development, and investment strategies.

Tips for Insurers Navigating the Future:

- Embrace digital transformation: Invest in technologies like AI, IoT, and blockchain to streamline operations, enhance customer experience, and drive innovation.

- Focus on customer experience: Prioritize customer-centric approaches, offering personalized solutions, seamless digital interactions, and proactive support.

- Leverage data analytics: Utilize data insights to understand customer behavior, assess risk, develop targeted products, and optimize operations.

- Stay informed about industry trends: Monitor emerging technologies, customer preferences, and regulatory changes to stay ahead of the curve.

- Build strategic partnerships: Collaborate with insurtech startups, fintech companies, and other industry players to leverage their expertise and expand reach.

- Develop climate-resilient products and strategies: Adapt risk assessment models, pricing strategies, and product offerings to address the growing risks associated with climate change.

Conclusion:

The insurance industry is on the brink of a profound transformation, driven by technological advancements, evolving customer expectations, and a changing global landscape. By embracing innovation, adapting to new business models, and prioritizing customer experience, insurers can navigate the challenges and capitalize on the opportunities presented by the trends shaping the future of insurance in 2025. The industry that emerges will be more agile, customer-centric, and technologically driven, offering a wider range of personalized and innovative solutions to meet the evolving needs of individuals and businesses.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Trends Shaping the Insurance Landscape in 2025. We thank you for taking the time to read this article. See you in our next article!