Navigating the Rhythms of the Market: Exploring Seasonal Trends in Stock Market 2025

Related Articles: Navigating the Rhythms of the Market: Exploring Seasonal Trends in Stock Market 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Rhythms of the Market: Exploring Seasonal Trends in Stock Market 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Rhythms of the Market: Exploring Seasonal Trends in Stock Market 2025

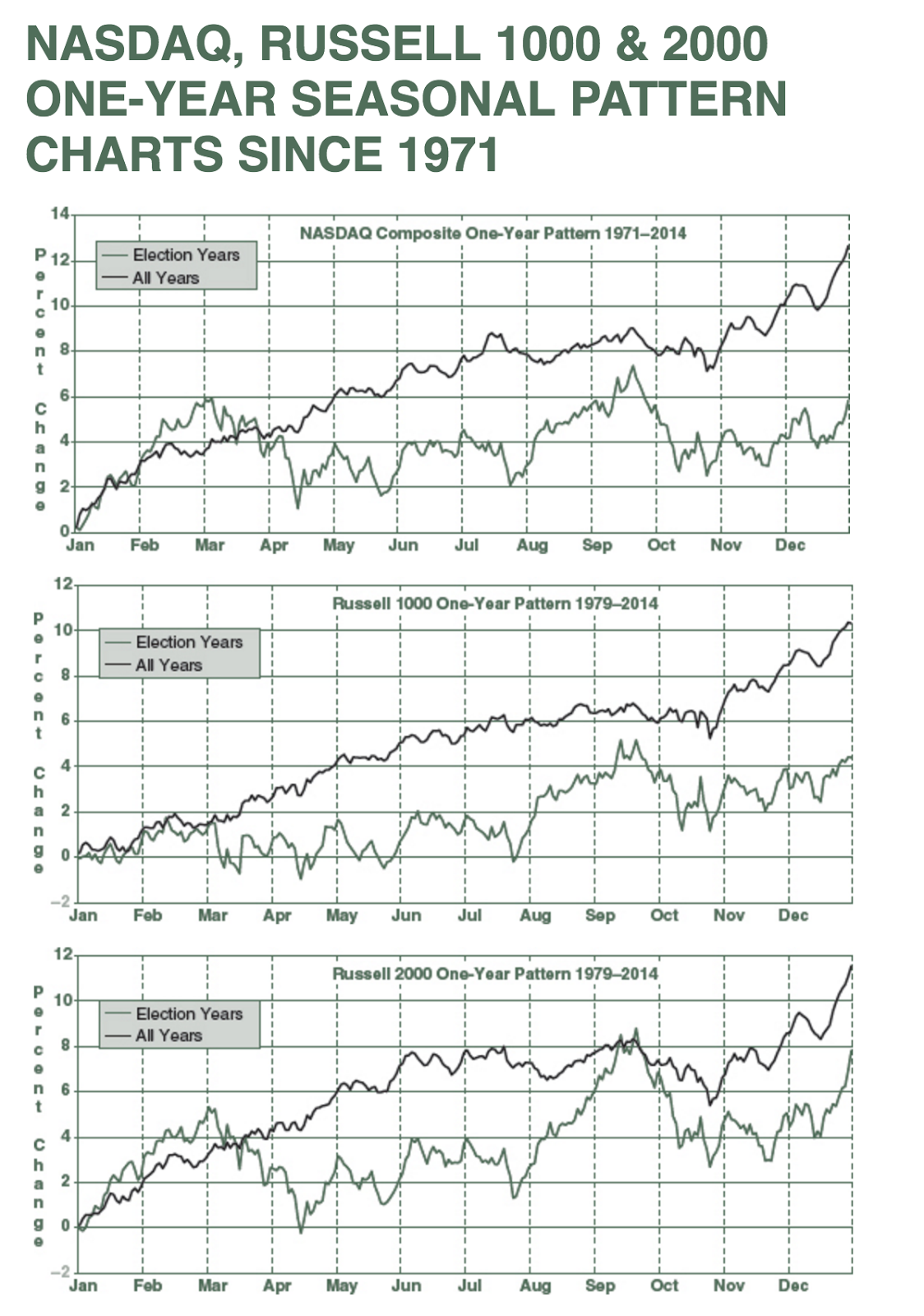

The stock market, a complex ecosystem driven by a myriad of factors, exhibits patterns that extend beyond the typical ups and downs of daily trading. One such pattern, often observed over long periods, is the influence of seasonality. Seasonal trends in stock market 2025 are likely to play a role in how investors navigate the market landscape.

While predicting the future with certainty is impossible, understanding these seasonal patterns can offer valuable insights for informed investment decisions. This exploration delves into the potential seasonal trends in stock market 2025, examining historical data, economic forecasts, and emerging market dynamics.

Understanding the Concept of Seasonal Trends

Seasonality in the stock market refers to the tendency for specific periods of the year to exhibit consistent, recurring patterns in stock prices. These patterns can be influenced by a variety of factors:

- Economic Activity: Certain sectors tend to perform better during specific times of the year. For example, retail stocks may see increased activity during holiday seasons, while energy companies may benefit from increased demand during winter months.

- Investor Sentiment: Market psychology can shift with the changing seasons. For instance, investors may be more optimistic during the spring, leading to higher market valuations.

- Corporate Earnings: Companies release their financial reports on a quarterly basis, and these reports can significantly impact stock prices. Seasonal trends can emerge as certain industries experience predictable peaks and troughs in earnings.

- Macroeconomic Events: Government policies, interest rate adjustments, and global events can have a seasonal impact on the market.

Exploring Potential Seasonal Trends in Stock Market 2025

While predicting the future is inherently uncertain, historical data and current market conditions offer insights into potential seasonal trends in stock market 2025.

1. January Effect:

The "January Effect" is a phenomenon observed in the stock market where stocks tend to experience higher returns during the month of January. This trend is often attributed to:

- Tax-Loss Selling: Investors may sell off losing stocks in December to realize capital losses for tax purposes, creating a buying opportunity in January.

- Year-End Optimism: Investors may be more optimistic about the market’s prospects at the start of a new year.

2. Santa Claus Rally:

This rally refers to a period of positive market performance during the last week of December and the first two trading days of January. It is believed to be fueled by:

- Holiday Cheer: A positive market sentiment associated with the holiday season.

- Year-End Portfolio Rebalancing: Investors may buy stocks to improve their portfolio performance before the year’s end.

3. Sell in May and Go Away:

This adage suggests that investors should sell their stock holdings in May and reinvest in the market later in the year. The rationale behind this belief is that:

- Summer Slump: The market may experience a period of lower returns during the summer months.

- Increased Volatility: The summer months often see increased volatility due to factors like vacation periods and reduced trading activity.

4. Summer Doldrums:

The summer months, particularly July and August, can see a slowdown in market activity. This is often attributed to:

- Reduced Trading Volume: Many investors take vacations during this period, leading to lower trading volumes.

- Earnings Season: Earnings reports are typically released in the summer, which can create uncertainty and volatility.

5. October Effect:

This effect suggests that the month of October has a tendency for lower market returns, potentially due to:

- Historically Poor Performance: Historically, October has been a month with a higher probability of market corrections.

- Halloween Effect: Some believe that the month’s name, associated with spooky events, can influence investor sentiment.

6. Year-End Tax-Loss Selling:

As the year draws to a close, investors may sell off losing stocks to realize capital losses for tax purposes, potentially leading to a dip in market performance.

7. Fourth Quarter Surge:

The fourth quarter (October to December) often sees a surge in market activity, driven by:

- Holiday Spending: Retailers and consumer-related businesses tend to perform well during the holiday season.

- Year-End Portfolio Rebalancing: Investors may adjust their portfolios to capitalize on potential year-end gains.

8. Earnings Season:

Earnings season, typically occurring in the first and third quarters of the year, can significantly impact stock prices. Companies release their financial reports, and these reports can drive market volatility and trends.

Important Considerations:

While these seasonal trends can offer insights into potential market movements, it’s essential to remember that they are not foolproof predictors. Other factors, including:

- Economic conditions

- Geopolitical events

- Market sentiment

- Company-specific news

can significantly influence stock prices and may override any seasonal patterns.

Related Searches:

- Seasonal stock market patterns: Explore historical data and studies on seasonal trends in the stock market.

- Best time to buy stocks: Analyze seasonal trends and identify potential entry points for investments.

- Sell in May and go away: Investigate the validity and effectiveness of this common investment strategy.

- January effect explained: Learn about the historical basis and potential drivers of the January effect.

- Stock market seasonality: Understand the various factors that contribute to seasonal trends in the stock market.

- Seasonal stock market calendar: Find resources that provide a calendar of key seasonal events and potential market impacts.

- Seasonal trading strategies: Explore different trading strategies that incorporate seasonal trends.

- Seasonal stock market analysis: Learn how to conduct a seasonal analysis of the stock market to identify potential opportunities.

FAQs by Seasonal Trends in Stock Market 2025:

Q: Are seasonal trends in the stock market reliable indicators of future performance?

A: Seasonal trends can offer insights into potential market movements, but they are not foolproof predictors. Other factors, such as economic conditions, geopolitical events, and company-specific news, can significantly influence stock prices.

Q: Should investors solely rely on seasonal trends when making investment decisions?

A: No, seasonal trends should be considered alongside other fundamental and technical analysis techniques. A comprehensive approach that considers multiple factors is crucial for informed investment decisions.

Q: How can I incorporate seasonal trends into my investment strategy?

A: You can use seasonal trends to:

- Identify potential entry and exit points: Consider buying stocks during periods when they historically tend to perform well and selling during periods of potential weakness.

- Adjust portfolio allocation: Adjust your portfolio allocation based on seasonal expectations for different sectors.

- Monitor market volatility: Be aware of periods of increased volatility associated with certain seasons.

Tips by Seasonal Trends in Stock Market 2025:

- Conduct thorough research: Analyze historical data and market conditions to identify potential seasonal trends.

- Diversify your portfolio: Spread your investments across different asset classes and sectors to mitigate risk.

- Stay informed: Keep abreast of economic news, geopolitical events, and company-specific developments.

- Consult with a financial advisor: Seek advice from a qualified professional to develop a personalized investment strategy.

- Don’t chase returns: Avoid making emotional investment decisions based solely on seasonal trends.

Conclusion by Seasonal Trends in Stock Market 2025:

Seasonal trends in stock market 2025 can offer valuable insights into potential market movements, but they should be considered alongside other fundamental and technical analysis techniques. Understanding these trends can help investors make more informed decisions, but it’s crucial to remember that the market is influenced by a multitude of factors, and predicting future performance with certainty is impossible. A comprehensive approach that considers economic conditions, geopolitical events, market sentiment, and company-specific news is essential for successful investment strategies.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Rhythms of the Market: Exploring Seasonal Trends in Stock Market 2025. We thank you for taking the time to read this article. See you in our next article!