Navigating the Uncertain Waters: Daily Mortgage Rate Trends in 2025

Related Articles: Navigating the Uncertain Waters: Daily Mortgage Rate Trends in 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Uncertain Waters: Daily Mortgage Rate Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Uncertain Waters: Daily Mortgage Rate Trends in 2025

- 2 Introduction

- 3 Navigating the Uncertain Waters: Daily Mortgage Rate Trends in 2025

- 3.1 Understanding the Factors Shaping Daily Mortgage Rate Trends

- 3.2 Daily Mortgage Rate Trends in 2025: Predictions and Possibilities

- 3.3 Daily Mortgage Rate Trends and Their Impact on the Housing Market

- 3.4 Daily Mortgage Rate Trends and Their Impact on the Economy

- 3.5 Related Searches:

- 3.6 FAQs about Daily Mortgage Rate Trends in 2025

- 3.7 Tips for Navigating Daily Mortgage Rate Trends in 2025

- 3.8 Conclusion

- 4 Closure

Navigating the Uncertain Waters: Daily Mortgage Rate Trends in 2025

Predicting the future is a risky endeavor, especially when it comes to volatile economic indicators like daily mortgage rate trends. However, by analyzing current economic factors, historical trends, and expert forecasts, we can gain valuable insights into the potential trajectory of mortgage rates in 2025.

Understanding the Factors Shaping Daily Mortgage Rate Trends

Several key factors influence daily mortgage rate fluctuations:

- Federal Reserve Monetary Policy: The Federal Reserve (Fed) plays a crucial role in setting interest rate benchmarks. When the Fed raises interest rates, it typically leads to higher mortgage rates, as lenders adjust their rates to reflect the increased cost of borrowing money. Conversely, when the Fed lowers interest rates, mortgage rates tend to decrease.

- Inflation: Rising inflation erodes purchasing power and can prompt the Fed to raise interest rates to curb inflation, consequently impacting mortgage rates. Conversely, falling inflation might lead to lower interest rates.

- Economic Growth: Strong economic growth often translates to higher interest rates as investors demand higher returns on their investments. Conversely, weak economic growth can lead to lower interest rates as lenders become more cautious about lending.

- Government Policies: Government policies, such as tax incentives for homeownership or changes in mortgage regulations, can influence the demand for mortgages and ultimately impact rates.

- Global Economic Conditions: Global events, such as international trade tensions or geopolitical instability, can impact investor confidence and influence interest rate movements, potentially affecting mortgage rates.

Daily Mortgage Rate Trends in 2025: Predictions and Possibilities

Forecasting daily mortgage rate trends with pinpoint accuracy is impossible. However, considering the current economic landscape and expert opinions, several scenarios are plausible:

Scenario 1: Continued Rise in Rates:

- If inflation remains stubbornly high, the Fed might continue to raise interest rates aggressively, potentially leading to a continued rise in mortgage rates in 2025.

- This scenario could make homeownership less affordable for many, potentially slowing down the housing market.

- It might also lead to a higher number of homeowners refinancing their mortgages at lower rates.

Scenario 2: Stabilization and Gradual Decline:

- If inflation cools down and economic growth slows, the Fed might pause its rate hikes or even start lowering interest rates in 2025.

- This could lead to a stabilization or gradual decline in mortgage rates, making homeownership more accessible for some.

- However, the potential for economic uncertainty might still dampen investor confidence and keep rates higher than pre-pandemic levels.

Scenario 3: Unexpected Volatility:

- Unforeseen events, such as a global recession or a major geopolitical crisis, could significantly impact the global economy and lead to unpredictable fluctuations in interest rates, including mortgage rates.

- This scenario poses a significant risk for both borrowers and lenders, creating market uncertainty and potentially leading to significant rate swings.

Daily Mortgage Rate Trends and Their Impact on the Housing Market

- Homebuyer Affordability: Rising mortgage rates directly impact homebuyer affordability, making it more expensive to purchase a home. This can lead to decreased demand in the housing market, potentially causing a slowdown in home price appreciation.

- Refinancing Activity: When mortgage rates fall, homeowners with existing mortgages may consider refinancing to secure a lower interest rate and reduce their monthly payments. This can lead to a surge in refinancing activity, benefiting both lenders and borrowers.

- Investor Activity: Rising mortgage rates can impact investor activity in the housing market, as higher borrowing costs can make investment properties less attractive. Conversely, falling mortgage rates might encourage more investors to enter the market.

Daily Mortgage Rate Trends and Their Impact on the Economy

- Consumer Spending: Higher mortgage rates can impact consumer spending by reducing disposable income available for other goods and services. This can potentially slow down economic growth.

- Housing Construction: Fluctuations in mortgage rates can affect the demand for new housing construction, leading to adjustments in the supply of homes and impacting the real estate industry.

- Financial Markets: Changes in mortgage rates can influence the performance of financial markets, as they impact the value of mortgage-backed securities and other related investments.

Related Searches:

1. Mortgage Rates Today: Staying informed about current mortgage rates is essential for making informed decisions. Websites like Bankrate, NerdWallet, and Mortgage News Daily provide up-to-date information on current mortgage rates.

2. Average Mortgage Rates: Understanding average mortgage rates provides a broader perspective on the current market and allows for comparison with historical trends. Websites like Freddie Mac and Fannie Mae publish weekly average mortgage rate data.

3. 30-Year Fixed Mortgage Rates: The 30-year fixed-rate mortgage is a popular choice for homeowners due to its predictable monthly payments. Tracking the daily trends in 30-year fixed mortgage rates is crucial for understanding the overall mortgage market.

4. 15-Year Fixed Mortgage Rates: 15-year fixed-rate mortgages offer lower interest rates than 30-year mortgages, resulting in faster loan repayment and lower overall interest costs. Monitoring 15-year fixed mortgage rate trends can help homeowners weigh the pros and cons of different loan options.

5. Adjustable-Rate Mortgages (ARMs): Adjustable-rate mortgages offer lower initial interest rates than fixed-rate mortgages but carry the risk of higher rates in the future. Tracking ARM rate trends can help homeowners understand the potential costs and benefits of this loan type.

6. Mortgage Rate Forecast: Numerous websites and financial institutions provide mortgage rate forecasts based on economic indicators and expert analysis. These forecasts can help homeowners understand the potential direction of rates in the future.

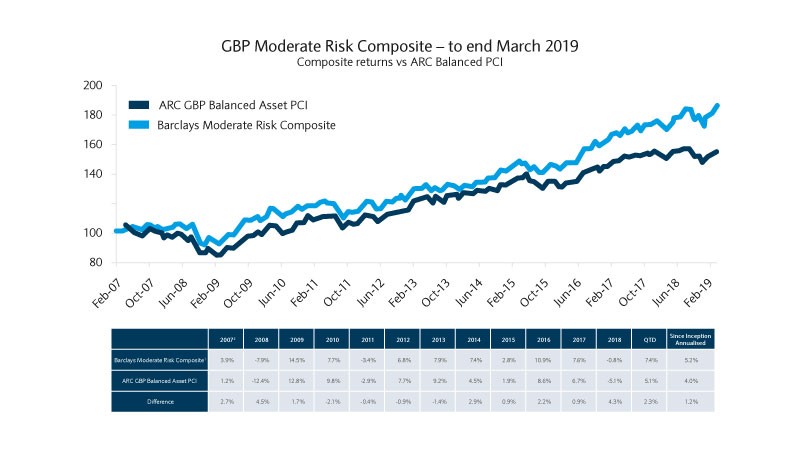

7. Mortgage Rate History: Understanding historical mortgage rate trends provides valuable context for current market conditions. Websites like Freddie Mac and the Federal Reserve offer historical mortgage rate data that can help homeowners understand long-term trends and cyclical patterns.

8. Mortgage Rate Calculator: Mortgage rate calculators allow homeowners to estimate their monthly payments based on different loan amounts, interest rates, and loan terms. This tool can be helpful for comparing different mortgage options and determining affordability.

FAQs about Daily Mortgage Rate Trends in 2025

Q: What are the current mortgage rates?

A: Current mortgage rates fluctuate daily and are best obtained from reputable sources like Bankrate, NerdWallet, or Mortgage News Daily.

Q: How do I find the best mortgage rate?

A: The best mortgage rate depends on your individual credit score, debt-to-income ratio, and loan amount. To find the best rate, consider shopping around with multiple lenders and comparing their offers.

Q: Will mortgage rates continue to rise in 2025?

A: Predicting future mortgage rates is challenging. The direction of rates will depend on various factors, including inflation, economic growth, and the Fed’s monetary policy decisions.

Q: What should I do if mortgage rates are high?

A: If mortgage rates are high, you might consider delaying your home purchase until rates fall or exploring alternative loan options, such as an adjustable-rate mortgage or a shorter-term loan.

Q: What should I do if mortgage rates are low?

A: If mortgage rates are low, it might be an opportune time to refinance your existing mortgage or purchase a home.

Tips for Navigating Daily Mortgage Rate Trends in 2025

- Stay Informed: Stay updated on current mortgage rates and economic news by following reputable sources like Bankrate, NerdWallet, and the Federal Reserve.

- Shop Around: Compare mortgage rates from multiple lenders to ensure you are getting the best possible deal.

- Consider Your Financial Situation: Evaluate your credit score, debt-to-income ratio, and financial goals before making any mortgage decisions.

- Lock in Rates When Favorable: If you find a favorable mortgage rate, consider locking it in to avoid potential rate increases.

- Seek Professional Advice: Consult with a mortgage broker or financial advisor for personalized advice and guidance.

Conclusion

Navigating daily mortgage rate trends in 2025 will require vigilance, flexibility, and informed decision-making. By understanding the factors influencing rate movements, staying informed about current market conditions, and seeking professional guidance, homeowners and prospective buyers can make informed decisions that align with their financial goals and circumstances. The ever-changing landscape of mortgage rates requires continuous monitoring and adaptation to ensure the most favorable outcomes in the dynamic housing market.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Uncertain Waters: Daily Mortgage Rate Trends in 2025. We hope you find this article informative and beneficial. See you in our next article!