Shaping the Future: Trends in Banking Industry 2025

Related Articles: Shaping the Future: Trends in Banking Industry 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Shaping the Future: Trends in Banking Industry 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Shaping the Future: Trends in Banking Industry 2025

- 2 Introduction

- 3 Shaping the Future: Trends in Banking Industry 2025

- 4 Related Searches

- 5 FAQs by Trends in Banking Industry 2025

- 6 Tips by Trends in Banking Industry 2025

- 7 Conclusion by Trends in Banking Industry 2025

- 8 Closure

Shaping the Future: Trends in Banking Industry 2025

The banking industry is undergoing a rapid transformation, driven by technological advancements, shifting customer expectations, and evolving regulatory landscapes. Looking ahead to 2025, several key trends will shape the future of banking, impacting how financial institutions operate, interact with customers, and deliver value.

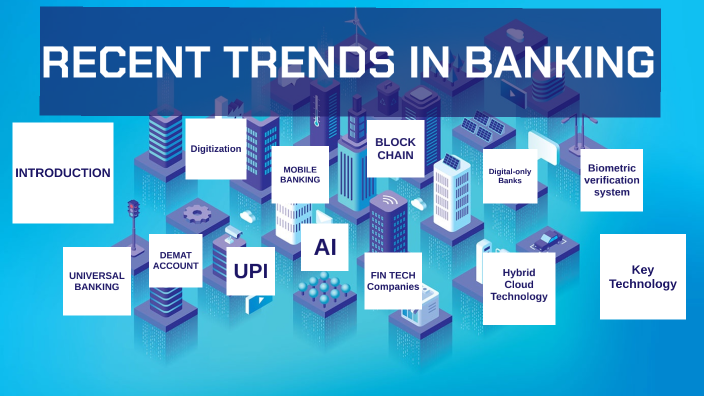

1. The Rise of Open Banking and Data-Driven Insights

Open banking is a key trend that empowers customers to share their financial data with third-party applications, enabling them to access innovative financial services and manage their finances more effectively.

-

Data-Driven Insights: Banks are leveraging the wealth of data available through open banking to gain deeper insights into customer behavior, preferences, and financial needs. This data analysis allows for personalized product recommendations, targeted marketing campaigns, and proactive risk management strategies.

-

Enhanced Customer Experience: By integrating with third-party apps and services, banks can offer customers a more seamless and personalized banking experience. This includes features like automatic bill payments, budgeting tools, and financial planning advice tailored to individual needs.

-

Emerging Business Models: Open banking paves the way for new business models, such as embedded finance, where financial services are integrated into non-financial platforms, like e-commerce websites or ride-sharing apps.

2. The Power of Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are revolutionizing banking operations, enhancing efficiency, and improving customer service.

-

Automated Processes: AI-powered automation streamlines repetitive tasks like loan processing, fraud detection, and customer support inquiries, freeing up human resources for more complex and strategic activities.

-

Personalized Customer Interactions: AI-powered chatbots and virtual assistants provide 24/7 customer support, answer questions, and resolve issues efficiently. These intelligent systems learn from interactions and adapt to individual customer needs, delivering personalized experiences.

-

Predictive Analytics: AI algorithms analyze vast amounts of data to identify patterns and predict future trends, enabling banks to anticipate customer needs, optimize risk management strategies, and develop innovative products and services.

3. The Growing Importance of Cybersecurity

As digital banking becomes increasingly prevalent, cybersecurity becomes paramount.

-

Evolving Threats: Banks face a constantly evolving threat landscape, with sophisticated cyberattacks targeting sensitive data, financial transactions, and critical infrastructure.

-

Robust Security Measures: To mitigate risks, banks are investing in robust security measures, including multi-factor authentication, encryption technologies, and advanced threat detection systems.

-

Proactive Security Posture: A proactive security posture involves continuous monitoring, regular security assessments, and ongoing employee training to stay ahead of emerging threats and minimize vulnerabilities.

4. The Rise of Fintech and the Competition for Innovation

Fintech companies are disrupting the traditional banking industry by offering innovative solutions and challenging existing business models.

-

Niche Solutions: Fintechs often focus on specific areas, such as payments, lending, wealth management, or insurance, offering specialized services and tailored solutions.

-

Agile Development: Fintechs are known for their agile development processes, allowing them to quickly adapt to changing market conditions and introduce new products and services.

-

Collaboration and Partnerships: Banks are increasingly collaborating with fintechs to leverage their expertise and innovative solutions, fostering a more competitive and dynamic ecosystem.

5. The Importance of Sustainability and Environmental, Social, and Governance (ESG) Factors

Environmental, social, and governance (ESG) factors are gaining prominence in the banking industry, as investors and customers increasingly prioritize sustainable practices.

-

Sustainable Finance: Banks are developing products and services that promote sustainable investments, such as green bonds and sustainable lending practices.

-

Environmental Responsibility: Banks are taking steps to reduce their environmental footprint by adopting energy-efficient technologies and promoting sustainable business practices.

-

Social Impact: Banks are engaging in initiatives that address social issues, such as financial inclusion, affordable housing, and education, demonstrating a commitment to social responsibility.

6. The Evolution of the Banking Workforce

The banking industry is undergoing a significant shift in its workforce, with a growing demand for specialized skills in technology, data analytics, and cybersecurity.

-

Digital Transformation: The adoption of digital technologies requires a workforce with strong technical skills to develop, implement, and maintain new systems.

-

Data-Driven Decision Making: Banks need data scientists, analysts, and other professionals with expertise in data management, analysis, and interpretation to leverage data for informed decision-making.

-

Cybersecurity Expertise: As cybersecurity threats increase, banks need to invest in cybersecurity professionals to protect their systems, data, and customers from cyberattacks.

7. The Future of Branch Banking: A Shift Towards Digital and Hybrid Models

The traditional brick-and-mortar branch model is evolving, with a shift towards digital and hybrid banking models.

-

Digital-First Approach: Many banks are adopting a digital-first approach, offering customers convenient and accessible online and mobile banking services.

-

Hybrid Banking Models: Hybrid models combine the convenience of digital banking with the personalized service and human interaction offered by physical branches.

-

Branch Transformation: Physical branches are being transformed into experience centers, offering specialized services, financial advice, and community engagement opportunities.

8. The Regulatory Landscape: Balancing Innovation and Consumer Protection

The regulatory landscape is constantly evolving, seeking to balance innovation with consumer protection and financial stability.

-

Open Banking Regulations: Regulations governing open banking aim to promote competition and innovation while protecting customer data and privacy.

-

Cybersecurity Regulations: Regulations are being implemented to strengthen cybersecurity measures and protect sensitive data from cyberattacks.

-

Financial Stability Regulations: Regulations are designed to ensure the stability of the financial system and prevent systemic risks.

Related Searches

1. Future of Banking Technology: This search explores emerging technologies shaping the banking industry, including blockchain, artificial intelligence, and the Internet of Things (IoT).

2. Digital Banking Trends: This search focuses on the growth of digital banking, including online banking, mobile banking, and digital payments.

3. Customer Experience in Banking: This search examines how banks are enhancing customer experience through personalized services, digital channels, and innovative technologies.

4. Banking Industry Regulations: This search explores current and evolving regulations impacting the banking industry, including open banking, cybersecurity, and financial stability.

5. Fintech and Banking: This search investigates the impact of fintech companies on the banking industry, including their innovative solutions and competition with traditional banks.

6. Sustainable Banking: This search focuses on the growing importance of sustainability in banking, including green finance, ESG investing, and social impact initiatives.

7. Banking Workforce Trends: This search examines the changing demographics and skillsets required in the banking workforce, including the demand for technology, data analytics, and cybersecurity expertise.

8. Branch Banking in the Future: This search explores the evolution of branch banking, including the shift towards digital and hybrid models, and the transformation of physical branches into experience centers.

FAQs by Trends in Banking Industry 2025

1. What are the benefits of open banking for customers?

Open banking empowers customers to share their financial data with third-party apps and services, enabling them to access innovative financial products and services, manage their finances more effectively, and enjoy a more personalized banking experience.

2. How is AI transforming the banking industry?

AI is automating processes, enhancing customer service through intelligent chatbots and virtual assistants, and enabling predictive analytics to anticipate customer needs and optimize risk management strategies.

3. What are the key cybersecurity challenges facing banks?

Banks face evolving cybersecurity threats, including sophisticated cyberattacks targeting sensitive data, financial transactions, and critical infrastructure. They need to invest in robust security measures to mitigate these risks.

4. How are fintech companies disrupting the banking industry?

Fintech companies are offering innovative solutions and challenging existing business models by focusing on specific areas like payments, lending, wealth management, or insurance. They are known for their agile development processes and ability to adapt to changing market conditions.

5. What are the key ESG considerations for banks?

Banks are increasingly incorporating ESG factors into their operations, developing sustainable finance products and services, reducing their environmental footprint, and engaging in initiatives that address social issues.

6. What are the future skills needed in the banking workforce?

The banking workforce needs to adapt to the digital transformation, with a growing demand for specialized skills in technology, data analytics, and cybersecurity.

7. What is the future of branch banking?

The traditional branch model is evolving, with a shift towards digital and hybrid banking models. Physical branches are being transformed into experience centers, offering specialized services, financial advice, and community engagement opportunities.

8. How are regulations evolving to address the changing banking landscape?

Regulations are evolving to balance innovation with consumer protection and financial stability, including regulations governing open banking, cybersecurity, and financial stability.

Tips by Trends in Banking Industry 2025

1. Embrace Open Banking: Banks should embrace open banking by investing in secure data sharing platforms and developing innovative products and services that leverage customer data.

2. Leverage AI and ML: Banks should invest in AI and ML technologies to automate processes, enhance customer service, and gain data-driven insights.

3. Strengthen Cybersecurity Posture: Banks need to prioritize cybersecurity by implementing robust security measures, conducting regular security assessments, and staying ahead of evolving threats.

4. Collaborate with Fintechs: Banks should explore partnerships with fintech companies to leverage their expertise and innovative solutions, fostering a more competitive and dynamic ecosystem.

5. Integrate ESG Considerations: Banks should integrate ESG factors into their business strategies, developing sustainable finance products, reducing their environmental footprint, and engaging in socially responsible initiatives.

6. Develop a Future-Ready Workforce: Banks should invest in training and development programs to equip their workforce with the skills needed for the digital age, including technology, data analytics, and cybersecurity.

7. Transform Branch Networks: Banks should transform their branch networks into experience centers, offering personalized services, financial advice, and community engagement opportunities.

8. Stay Informed of Regulatory Changes: Banks need to stay informed of evolving regulations and adapt their business practices to comply with new requirements.

Conclusion by Trends in Banking Industry 2025

The banking industry is on the cusp of significant transformation, driven by technological advancements, shifting customer expectations, and evolving regulatory landscapes. The trends outlined above will shape the future of banking, impacting how financial institutions operate, interact with customers, and deliver value.

By embracing innovation, adapting to changing customer needs, and prioritizing cybersecurity and sustainability, banks can navigate these trends effectively and position themselves for success in the years to come. The banking industry is poised to play a vital role in shaping the future of finance, driving economic growth, and enhancing the lives of individuals and communities around the world.

Closure

Thus, we hope this article has provided valuable insights into Shaping the Future: Trends in Banking Industry 2025. We thank you for taking the time to read this article. See you in our next article!