The Evolving Landscape of Banking: Digital Banking Trends Shaping 2025

Related Articles: The Evolving Landscape of Banking: Digital Banking Trends Shaping 2025

Introduction

With great pleasure, we will explore the intriguing topic related to The Evolving Landscape of Banking: Digital Banking Trends Shaping 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Evolving Landscape of Banking: Digital Banking Trends Shaping 2025

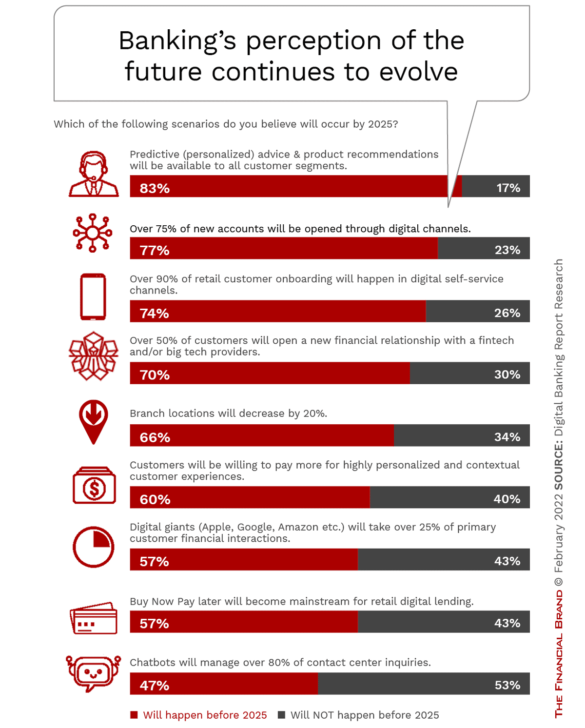

The financial services industry is in a state of constant evolution, with digital banking trends rapidly transforming the way individuals and businesses manage their finances. As we approach 2025, the landscape is poised for even more dramatic shifts, driven by technological advancements, changing customer expectations, and a growing emphasis on personalization and data-driven insights. This article delves into the key trends shaping the future of banking, offering a comprehensive understanding of the forces driving innovation and the impact on the industry and its customers.

1. The Rise of Super Apps:

The concept of "super apps" is gaining traction, offering a single platform for a wide range of financial and non-financial services. These platforms integrate banking, payments, investments, insurance, shopping, travel, and even healthcare, creating a holistic ecosystem for users.

-

Benefits:

- Convenience: Super apps eliminate the need for multiple apps, simplifying financial management and streamlining daily transactions.

- Personalized Experiences: Super apps leverage user data to offer tailored recommendations and services, enhancing customer engagement.

- Increased Revenue Streams: Banks can expand their offerings and generate new revenue streams by integrating services beyond traditional banking.

-

Examples: WeChat Pay and Alipay in China, Grab in Southeast Asia, and Gojek in Indonesia are leading examples of successful super apps.

2. Embedded Finance:

Embedded finance, the seamless integration of financial services within non-financial platforms, is revolutionizing the way customers access and manage their finances. This trend allows users to access banking services directly within their favorite apps, such as e-commerce platforms, ride-hailing services, or social media platforms.

-

Benefits:

- Frictionless Transactions: Embedded finance eliminates the need for users to switch between apps, creating a more streamlined and convenient experience.

- Increased Accessibility: By integrating financial services into everyday apps, embedded finance makes banking more accessible to a wider audience.

- New Revenue Streams: Non-financial companies can generate revenue through financial services, diversifying their business models.

-

Examples: Amazon Pay, PayPal, and Apple Pay are examples of embedded finance solutions.

3. The Power of Artificial Intelligence (AI):

AI is transforming the banking industry, automating tasks, improving customer service, and enabling more personalized and data-driven insights.

-

Benefits:

- Enhanced Customer Service: Chatbots powered by AI provide 24/7 support, answering customer queries and resolving issues quickly and efficiently.

- Fraud Detection and Prevention: AI algorithms can detect suspicious transactions and patterns, helping banks prevent fraud and protect customers.

- Personalized Recommendations: AI analyzes customer data to provide tailored financial advice, investment recommendations, and product suggestions.

-

Examples: Banks are using AI for tasks like credit scoring, loan approval, and risk assessment.

4. The Growing Importance of Data Security:

As banking becomes increasingly digital, the need for robust data security measures is paramount. Banks are investing heavily in cybersecurity technologies and implementing stringent protocols to protect customer data from breaches and cyberattacks.

-

Benefits:

- Enhanced Customer Trust: Strong security measures instill confidence in customers, ensuring their financial information is safe and secure.

- Reduced Risk of Financial Loss: Effective security protocols minimize the risk of data breaches, protecting both banks and customers from financial losses.

- Compliance with Regulations: Banks must comply with evolving regulations regarding data privacy and security, which strengthens the overall security landscape.

-

Examples: Banks are implementing multi-factor authentication, encryption, and advanced threat detection systems to safeguard customer data.

5. The Rise of Open Banking:

Open banking allows customers to share their financial data with third-party apps and services with their consent. This trend empowers customers to manage their finances more effectively and access a wider range of financial products and services.

-

Benefits:

- Enhanced Financial Control: Open banking gives customers greater control over their financial data, allowing them to track spending, manage budgets, and compare financial products.

- Increased Competition: Open banking fosters competition among financial institutions, driving innovation and offering customers more choices and better deals.

- Improved Financial Literacy: Open banking can help customers better understand their finances, enabling them to make informed financial decisions.

-

Examples: The UK’s Open Banking initiative and the European Union’s Payment Services Directive 2 (PSD2) are leading examples of open banking frameworks.

6. The Adoption of Blockchain Technology:

Blockchain technology is transforming the financial industry, offering secure and transparent transactions, improved efficiency, and reduced costs.

-

Benefits:

- Faster and Cheaper Transactions: Blockchain can streamline transactions, reducing processing times and associated fees.

- Increased Transparency: Blockchain records all transactions on a public ledger, ensuring transparency and accountability.

- Enhanced Security: Blockchain’s decentralized nature makes it highly secure, resistant to fraud and manipulation.

-

Examples: Banks are exploring blockchain for cross-border payments, trade finance, and asset management.

7. The Growing Importance of Fintech Partnerships:

Banks are increasingly collaborating with fintech companies to leverage their expertise and innovative technologies. These partnerships allow banks to access cutting-edge solutions, improve their offerings, and stay ahead of the competition.

-

Benefits:

- Access to Innovation: Banks can tap into fintech’s agility and innovative solutions to enhance their products and services.

- Improved Customer Experience: Fintech partnerships can help banks deliver a more personalized and seamless customer experience.

- Faster Time to Market: Collaborating with fintechs allows banks to bring new products and services to market faster, responding to changing customer needs.

-

Examples: Banks are partnering with fintechs for areas like payments, lending, and wealth management.

8. The Focus on Financial Wellness:

Banks are shifting their focus from simply providing financial services to promoting financial well-being. This involves offering tools, resources, and advice to help customers manage their finances effectively and achieve their financial goals.

-

Benefits:

- Increased Customer Loyalty: Banks that prioritize financial wellness build stronger relationships with customers, fostering loyalty and trust.

- Improved Financial Outcomes: By empowering customers to make informed financial decisions, banks can help them achieve their financial goals.

- Positive Social Impact: Promoting financial wellness contributes to a more financially stable society, reducing financial stress and promoting economic growth.

-

Examples: Banks are offering financial literacy programs, budgeting tools, and personalized financial planning services.

Related Searches:

1. Digital Banking Trends 2023: Understanding the current trends in digital banking provides context for the future.

2. Digital Banking Trends 2024: Examining the trends expected to emerge in 2024 helps predict the trajectory of the industry.

3. Future of Banking: Exploring the broader vision of the banking industry, including the impact of emerging technologies and changing customer behaviors.

4. Digital Transformation in Banking: Understanding the process of adopting digital technologies and transforming traditional banking operations.

5. Mobile Banking Trends: Focusing on the specific trends impacting mobile banking, including app features, security, and user experience.

6. Fintech Innovation: Exploring the role of fintech startups in driving innovation and shaping the future of banking.

7. Customer Experience in Banking: Analyzing customer expectations and preferences for digital banking services, including personalization, convenience, and security.

8. Banking Regulations: Understanding the evolving regulatory landscape impacting digital banking, including data privacy, cybersecurity, and open banking.

FAQs:

1. What are the key challenges facing digital banking in 2025?

- Cybersecurity: The increasing reliance on digital technologies exposes banks to new cybersecurity threats, requiring robust security measures.

- Regulatory Compliance: Evolving regulations regarding data privacy, open banking, and anti-money laundering pose challenges for banks.

- Customer Adoption: Not all customers are comfortable with digital banking, requiring banks to address concerns and provide adequate support.

- Competition from Fintechs: Fintech startups are disrupting the traditional banking landscape, forcing banks to innovate and adapt to stay competitive.

2. How will digital banking trends impact customers?

- Enhanced Convenience: Customers will enjoy more convenient and accessible banking services, with transactions and financial management becoming simpler.

- Personalized Experiences: Banks will leverage data to offer tailored financial advice, product recommendations, and personalized services.

- Increased Financial Control: Open banking will empower customers to manage their financial data and access a wider range of financial products.

- Improved Financial Literacy: Banks will offer tools and resources to help customers make informed financial decisions and achieve their financial goals.

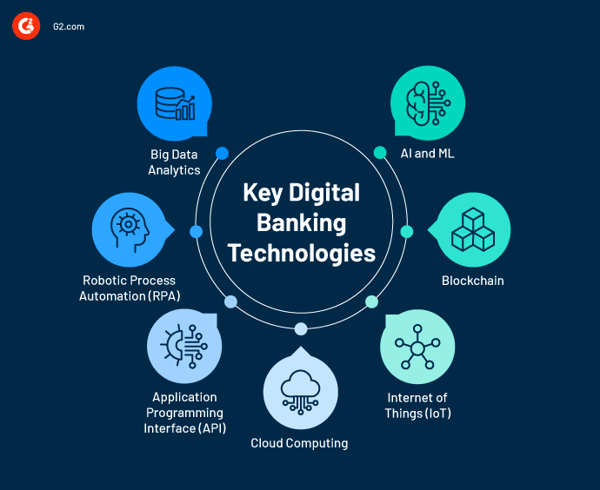

3. What are the key technologies driving digital banking trends?

- Artificial Intelligence (AI): AI is automating tasks, improving customer service, and enabling data-driven insights.

- Blockchain: Blockchain technology offers secure and transparent transactions, improving efficiency and reducing costs.

- Cloud Computing: Cloud computing enables banks to access scalable and flexible computing resources, supporting digital banking initiatives.

- Big Data Analytics: Banks are leveraging big data analytics to gain insights into customer behavior and market trends.

Tips for Banks:

- Embrace Innovation: Stay ahead of the curve by investing in emerging technologies and collaborating with fintech companies.

- Prioritize Customer Experience: Focus on providing seamless, personalized, and secure digital banking experiences.

- Invest in Cybersecurity: Implement robust security measures to protect customer data and build trust.

- Promote Financial Wellness: Offer tools, resources, and advice to help customers manage their finances effectively.

- Stay Compliant: Ensure compliance with evolving regulations regarding data privacy, open banking, and cybersecurity.

Conclusion:

The future of banking is digital, with digital banking trends driving a fundamental shift in how financial services are delivered and consumed. By embracing innovation, prioritizing customer experience, and adapting to the evolving regulatory landscape, banks can thrive in this dynamic environment. The trends outlined in this article highlight the opportunities and challenges facing the industry, providing valuable insights for banks seeking to navigate the changing landscape and secure their future success.

Closure

Thus, we hope this article has provided valuable insights into The Evolving Landscape of Banking: Digital Banking Trends Shaping 2025. We appreciate your attention to our article. See you in our next article!