The Evolving Landscape of Payments: Trends Shaping the Future of Commerce in 2025

Related Articles: The Evolving Landscape of Payments: Trends Shaping the Future of Commerce in 2025

Introduction

With great pleasure, we will explore the intriguing topic related to The Evolving Landscape of Payments: Trends Shaping the Future of Commerce in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: The Evolving Landscape of Payments: Trends Shaping the Future of Commerce in 2025

- 2 Introduction

- 3 The Evolving Landscape of Payments: Trends Shaping the Future of Commerce in 2025

- 3.1 1. The Rise of Digital Wallets and Mobile Payments

- 3.2 2. The Growth of Buy Now, Pay Later (BNPL) Solutions

- 3.3 3. The Rise of Embedded Finance

- 3.4 4. The Importance of Security and Data Privacy

- 3.5 5. The Evolution of Payment Methods

- 3.6 6. The Importance of a Seamless User Experience

- 3.7 7. The Role of Artificial Intelligence (AI) in Payments

- 3.8 8. The Growing Importance of Sustainability in Payments

- 4 Related Searches

- 5 FAQs

- 6 Tips

- 7 Conclusion

- 8 Closure

The Evolving Landscape of Payments: Trends Shaping the Future of Commerce in 2025

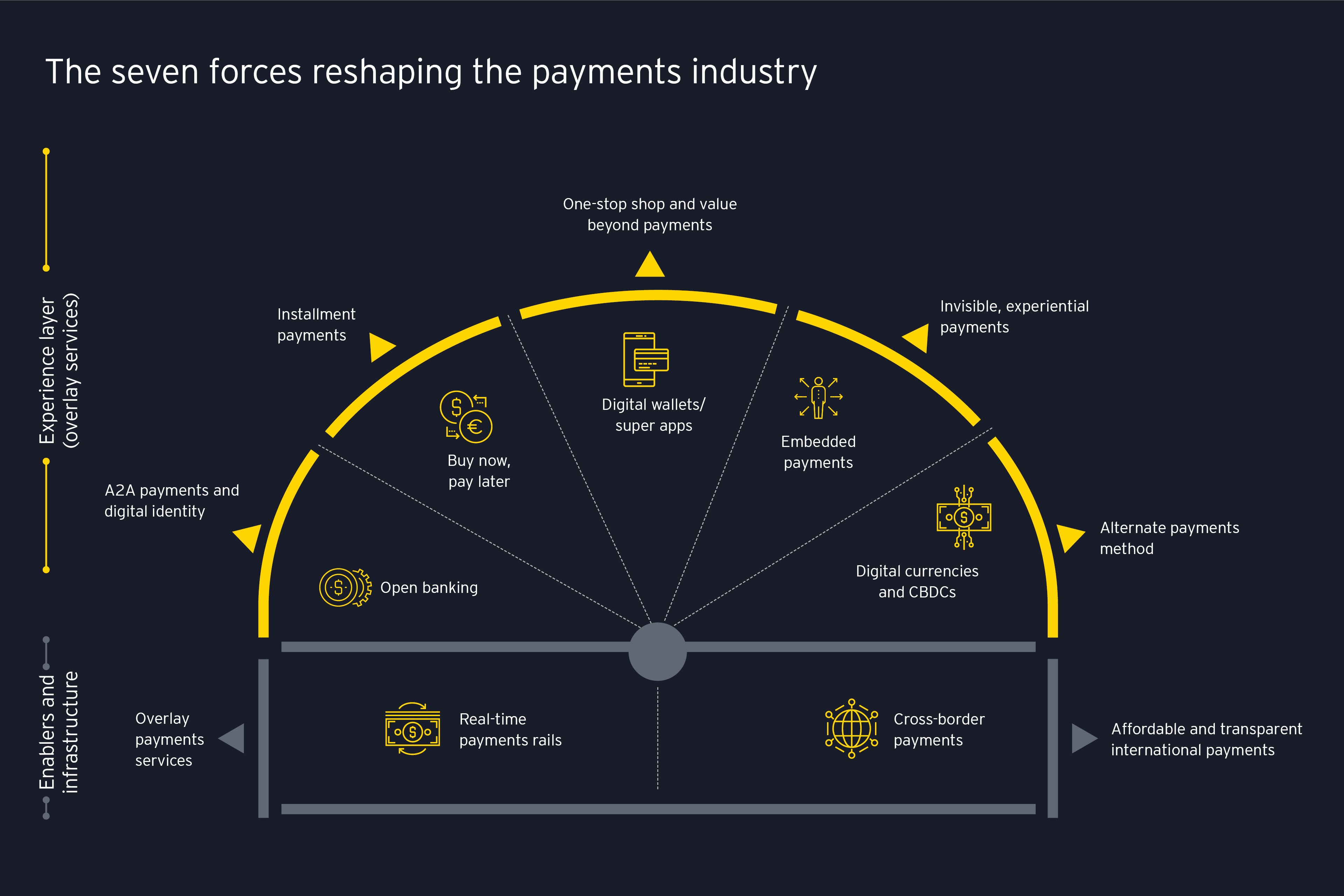

The payments landscape is undergoing a rapid transformation, driven by technological advancements, shifting consumer preferences, and the increasing demand for seamless, secure, and convenient transactions. As we approach 2025, several key trends are poised to shape the future of payments, impacting businesses and consumers alike.

Trends in Payments 2025

1. The Rise of Digital Wallets and Mobile Payments

Digital wallets and mobile payments have already gained significant traction, and this trend is set to accelerate in the coming years. Consumers are increasingly opting for the convenience and security of mobile payment solutions, facilitated by the widespread adoption of smartphones and the availability of robust mobile payment platforms.

Key Drivers:

- Convenience: Mobile payments allow consumers to make purchases quickly and easily, eliminating the need for cash or physical cards.

- Security: Mobile wallets often incorporate advanced security features, such as biometrics and tokenization, making transactions more secure than traditional payment methods.

- Integration: Mobile wallets are seamlessly integrated with various online and offline platforms, allowing for a unified payment experience across different channels.

- Emerging Technologies: The integration of technologies like Near Field Communication (NFC) and QR codes further enhances the accessibility and convenience of mobile payments.

Impact:

- Increased adoption: Mobile payment adoption will continue to grow, particularly in emerging markets where mobile penetration is high.

- Competition: Traditional payment processors and financial institutions will face increasing competition from fintech companies offering innovative mobile payment solutions.

- Shifting consumer behavior: Consumers will become increasingly accustomed to contactless payments, driving demand for digital wallets and mobile payment options.

2. The Growth of Buy Now, Pay Later (BNPL) Solutions

Buy Now, Pay Later (BNPL) solutions have emerged as a popular alternative to traditional credit cards, allowing consumers to make purchases and pay them off in installments over a period of time. This trend is fueled by the desire for flexible payment options and the increasing availability of BNPL services across various online and offline retailers.

Key Drivers:

- Affordability: BNPL solutions offer consumers a way to spread out the cost of purchases, making them more affordable.

- Convenience: The ease of use and integration of BNPL services into online shopping platforms makes them highly convenient for consumers.

- Accessibility: BNPL services are often more accessible than traditional credit cards, particularly for individuals with limited credit history.

- Growing popularity: The popularity of BNPL services is increasing rapidly, driven by the growing adoption of e-commerce and the desire for flexible payment options.

Impact:

- Increased competition: Traditional financial institutions will face growing competition from fintech companies offering BNPL services.

- Shifting consumer behavior: Consumers are becoming increasingly comfortable with using BNPL services, which could potentially impact the use of credit cards.

- Regulation: Regulators are increasingly focusing on the potential risks associated with BNPL services, leading to stricter regulations in the future.

3. The Rise of Embedded Finance

Embedded finance refers to the integration of financial services into non-financial platforms. This trend is driven by the increasing demand for seamless and personalized financial experiences, leading to the integration of payment solutions, lending, insurance, and other financial products into platforms like e-commerce, ride-hailing, and social media.

Key Drivers:

- Convenience: Embedded finance eliminates the need for consumers to switch between multiple platforms to access financial services, creating a more convenient experience.

- Personalization: By integrating financial services into existing platforms, businesses can offer personalized financial products and services tailored to individual needs.

- Data-driven insights: Embedded finance allows businesses to collect valuable data on consumer behavior, enabling them to develop more targeted financial products and services.

- Increased competition: Fintech companies are actively developing embedded finance solutions, driving competition in the traditional financial services sector.

Impact:

- Disruption: Embedded finance is disrupting traditional financial services by blurring the lines between financial and non-financial businesses.

- Innovation: Embedded finance is fostering innovation in the financial services sector, leading to the development of new products and services.

- Increased customer engagement: Businesses can leverage embedded finance to enhance customer engagement and loyalty by providing seamless access to financial services.

4. The Importance of Security and Data Privacy

As payments become increasingly digital, the need for robust security measures and data privacy protection becomes paramount. Consumers are demanding greater transparency and control over their data, and businesses are investing in advanced security technologies to protect sensitive information.

Key Drivers:

- Growing cyber threats: The increasing reliance on digital payments has made them a prime target for cybercriminals, necessitating robust security measures.

- Data privacy regulations: Governments worldwide are implementing stricter data privacy regulations, such as the General Data Protection Regulation (GDPR) in the EU, requiring businesses to protect consumer data.

- Consumer awareness: Consumers are becoming more aware of data privacy risks and demanding greater transparency from businesses regarding how their data is collected and used.

Impact:

- Increased investment in security: Businesses are investing heavily in advanced security technologies, such as encryption, tokenization, and multi-factor authentication, to protect sensitive data.

- Compliance with regulations: Businesses must comply with evolving data privacy regulations to avoid fines and penalties.

- Building trust: Businesses need to prioritize security and data privacy to build trust with consumers and maintain their reputation.

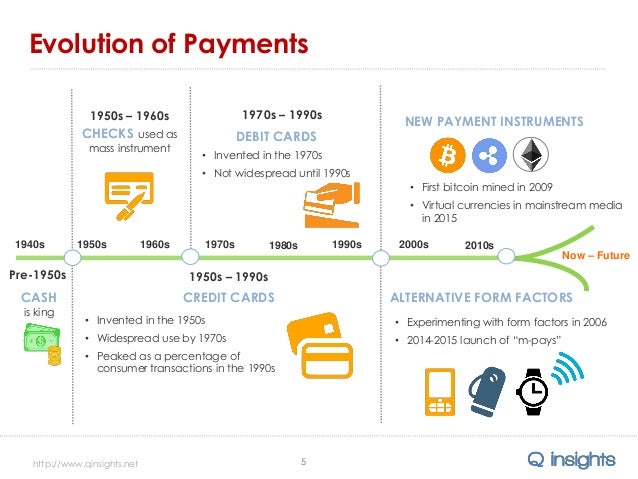

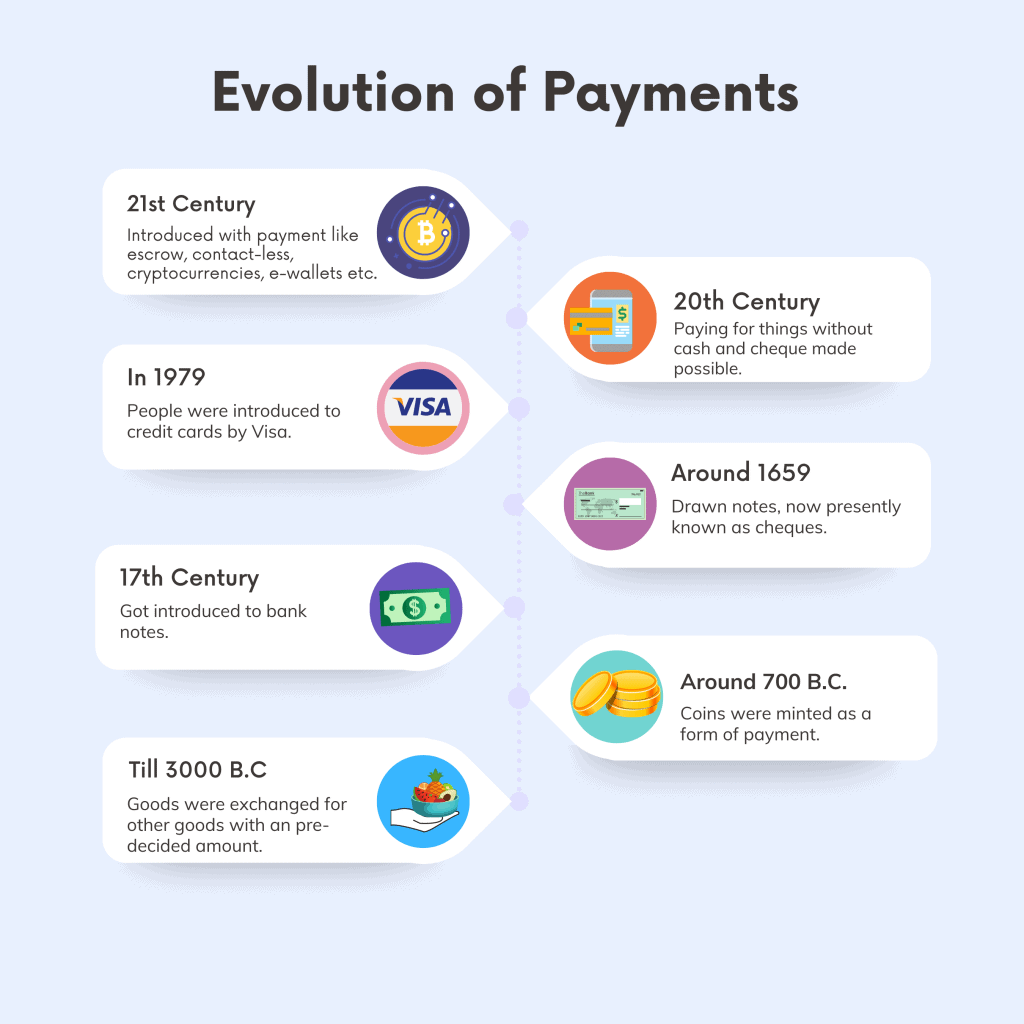

5. The Evolution of Payment Methods

The payments landscape is constantly evolving, with new payment methods emerging to cater to specific needs and preferences. These include:

- Cryptocurrency payments: The adoption of cryptocurrencies as a payment method is growing, particularly in the online retail sector.

- Biometric authentication: Facial recognition, fingerprint scanning, and voice authentication are becoming increasingly popular for secure and convenient payment authentication.

- Contactless payments: Contactless payment options like NFC and QR codes are gaining traction as consumers seek faster and more hygienic payment methods.

Impact:

- Increased choice for consumers: The availability of diverse payment methods provides consumers with greater choice and flexibility.

- Innovation: The emergence of new payment methods drives innovation in the payments sector, leading to the development of new technologies and solutions.

- Global reach: Some payment methods, such as cryptocurrencies, have the potential to facilitate cross-border transactions more efficiently.

6. The Importance of a Seamless User Experience

Consumers expect a seamless and frictionless payment experience, regardless of the platform or device they are using. Businesses are investing in user-friendly interfaces, intuitive payment flows, and personalized payment options to enhance the customer experience.

Key Drivers:

- Increased competition: Businesses are competing for customer attention and loyalty, emphasizing the importance of a positive payment experience.

- Consumer expectations: Consumers are demanding a seamless and convenient payment experience, similar to their experiences with other online services.

- Data-driven insights: Businesses are leveraging data analytics to understand customer preferences and optimize the payment experience.

Impact:

- Increased customer satisfaction: A seamless payment experience leads to increased customer satisfaction and loyalty.

- Reduced cart abandonment: A frictionless payment process can reduce cart abandonment rates, leading to increased sales.

- Improved conversion rates: A positive payment experience can improve conversion rates by encouraging customers to complete purchases.

7. The Role of Artificial Intelligence (AI) in Payments

AI is transforming the payments industry by automating processes, improving security, and enhancing customer experiences. AI-powered solutions are being used for fraud detection, risk assessment, customer support, and personalized payment recommendations.

Key Drivers:

- Data analysis: AI can analyze vast amounts of data to identify patterns and anomalies, improving fraud detection and risk management.

- Process automation: AI can automate repetitive tasks, such as transaction processing and customer service, freeing up human resources for more strategic tasks.

- Personalization: AI can personalize the payment experience by providing customized recommendations and offers based on individual preferences.

Impact:

- Enhanced security: AI-powered solutions can improve security by detecting and preventing fraudulent transactions in real-time.

- Improved efficiency: AI can automate processes, making payments more efficient and cost-effective.

- Personalized experiences: AI can personalize the payment experience, enhancing customer satisfaction and loyalty.

8. The Growing Importance of Sustainability in Payments

Sustainability is becoming an increasingly important consideration in the payments industry. Businesses are exploring ways to reduce their environmental footprint by adopting environmentally friendly payment solutions and reducing their reliance on physical infrastructure.

Key Drivers:

- Consumer demand: Consumers are increasingly demanding sustainable products and services, including payment solutions.

- Environmental regulations: Governments are introducing stricter environmental regulations, encouraging businesses to adopt sustainable practices.

- Corporate social responsibility: Businesses are increasingly prioritizing environmental sustainability as part of their corporate social responsibility initiatives.

Impact:

- Innovation in sustainable payments: Businesses are developing innovative payment solutions that reduce their environmental impact.

- Increased transparency: Businesses are becoming more transparent about their environmental practices, allowing consumers to make informed choices.

- Competitive advantage: Adopting sustainable practices can provide businesses with a competitive advantage, attracting environmentally conscious consumers.

Related Searches

- Trends in payment processing: This search explores the technological advancements and innovations shaping the processing of payments, including real-time processing, faster transaction speeds, and improved security measures.

- Future of payments: This search delves into the long-term trends and predictions for the payments industry, including the potential impact of emerging technologies like blockchain and the metaverse.

- Mobile payment trends: This search focuses on the specific trends and developments in the mobile payments space, including the adoption of new payment methods, increased security features, and the integration of mobile wallets with other platforms.

- Payments industry trends: This search provides a broader overview of the trends and innovations shaping the payments industry, including the rise of fintech companies, the adoption of open banking, and the increasing importance of data privacy.

- Trends in online payments: This search focuses on the specific trends and developments in the online payments sector, including the growth of e-commerce, the adoption of new payment methods, and the increasing importance of a seamless user experience.

- Payment security trends: This search explores the latest trends in payment security, including the adoption of advanced security technologies, the growing importance of data privacy, and the evolving landscape of cyber threats.

- Trends in contactless payments: This search focuses on the specific trends and developments in the contactless payments space, including the growing adoption of NFC and QR code payments, the increasing popularity of mobile wallets, and the impact of contactless payments on consumer behavior.

- Trends in alternative payment methods: This search explores the emergence of alternative payment methods, including BNPL solutions, cryptocurrency payments, and other innovative payment options.

FAQs

1. What are the key drivers of the trends in payments 2025?

The key drivers of trends in payments 2025 include:

- Technological advancements: The rapid pace of technological innovation is fueling the development of new payment methods, platforms, and security solutions.

- Shifting consumer preferences: Consumers are increasingly demanding convenient, secure, and personalized payment experiences.

- Growing competition: The payments industry is becoming increasingly competitive, with traditional financial institutions facing challenges from fintech companies and other innovative players.

- Regulatory changes: Governments are implementing new regulations to address data privacy concerns and ensure the security of digital payments.

2. How will these trends impact businesses?

These trends will have a significant impact on businesses, requiring them to adapt their payment strategies and embrace new technologies. Key impacts include:

- Increased competition: Businesses will face increased competition from fintech companies and other innovative players offering new payment solutions.

- Need for innovation: Businesses will need to invest in innovation to develop new payment solutions and stay ahead of the curve.

- Enhanced security: Businesses will need to prioritize security and data privacy to protect customer information and maintain trust.

- Focus on customer experience: Businesses will need to focus on providing a seamless and personalized payment experience to meet evolving customer expectations.

3. How will these trends impact consumers?

These trends will offer consumers greater choice, convenience, and security when making payments. Key impacts include:

- Increased payment options: Consumers will have access to a wider range of payment methods, including mobile wallets, BNPL solutions, and cryptocurrency payments.

- Enhanced security: Consumers will benefit from improved security measures, such as biometrics and tokenization, making their payments more secure.

- Personalized experiences: Consumers will experience more personalized payment options, tailored to their individual needs and preferences.

4. What are the potential risks associated with these trends?

While these trends offer numerous benefits, they also present potential risks:

- Data privacy concerns: The increasing reliance on digital payments raises concerns about data privacy and the potential for misuse of personal information.

- Cybersecurity threats: The growing complexity of the payments landscape increases the risk of cyberattacks and data breaches.

- Financial exclusion: The rapid adoption of new technologies could lead to financial exclusion for individuals who lack access to technology or digital literacy.

5. What are the key takeaways for businesses?

Businesses need to stay informed about the latest trends in payments and adapt their strategies accordingly. Key takeaways include:

- Embrace innovation: Invest in new technologies and payment solutions to stay competitive.

- Prioritize security: Implement robust security measures to protect customer data and maintain trust.

- Focus on customer experience: Provide a seamless and personalized payment experience to meet evolving customer expectations.

- Stay informed about regulations: Comply with evolving data privacy regulations and other industry standards.

Tips

- Invest in mobile payment solutions: Businesses should consider offering mobile payment options, such as digital wallets and mobile payment platforms, to cater to the growing demand for convenient and secure payments.

- Explore BNPL solutions: Businesses should consider integrating BNPL services into their payment options to offer flexible payment choices to consumers.

- Embrace embedded finance: Businesses should explore opportunities to integrate financial services into their platforms, offering personalized financial products and services.

- Prioritize security and data privacy: Businesses should invest in advanced security technologies and implement robust data privacy practices to protect customer information.

- Focus on user experience: Businesses should prioritize user-friendly interfaces, intuitive payment flows, and personalized payment options to enhance the customer experience.

- Stay informed about industry trends: Businesses should stay informed about the latest developments in the payments industry, including new payment methods, technologies, and regulations.

Conclusion

The trends in payments 2025 are reshaping the way businesses and consumers interact with financial services. The increasing adoption of digital wallets, BNPL solutions, embedded finance, and other innovative payment methods is driving a shift towards a more convenient, secure, and personalized payment experience. Businesses need to adapt their strategies and embrace these trends to remain competitive and meet the evolving needs of their customers. By staying informed about the latest developments, investing in innovation, and prioritizing security and customer experience, businesses can thrive in the evolving payments landscape.

Closure

Thus, we hope this article has provided valuable insights into The Evolving Landscape of Payments: Trends Shaping the Future of Commerce in 2025. We appreciate your attention to our article. See you in our next article!