US Economy Trends 2025: A Comprehensive Outlook

Related Articles: US Economy Trends 2025: A Comprehensive Outlook

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to US Economy Trends 2025: A Comprehensive Outlook. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

US Economy Trends 2025: A Comprehensive Outlook

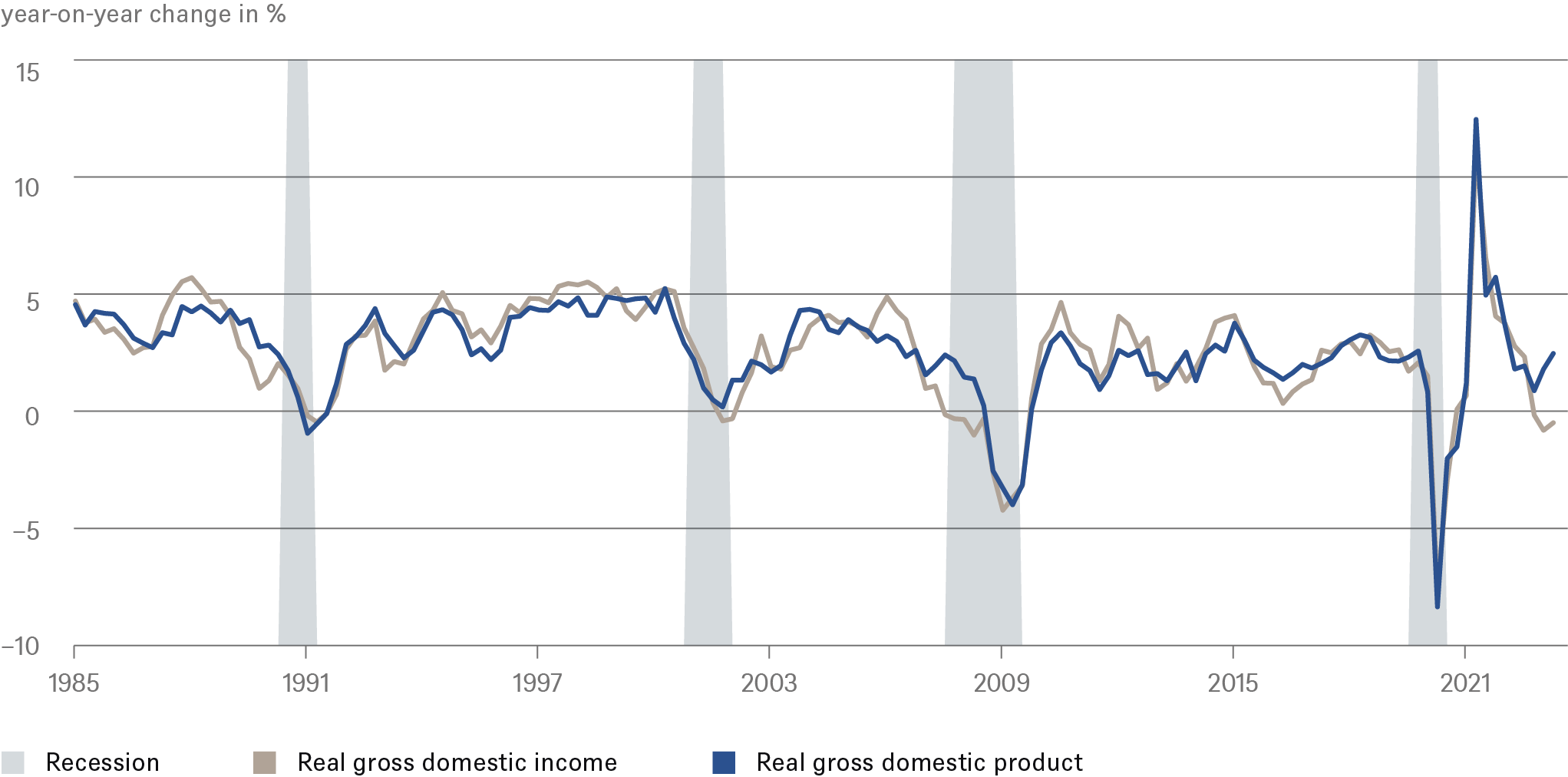

The US economy, the world’s largest, is a complex and dynamic system, constantly evolving under the influence of numerous factors. Predicting its future trajectory is a challenging task, but understanding current trends and potential drivers can offer valuable insights into the economic landscape of 2025. This article delves into key US Economy Trends 2025, exploring their potential impact and implications for businesses, investors, and individuals.

1. Technological Advancements and Automation

Technological advancements, particularly in artificial intelligence (AI), automation, and robotics, are reshaping the US economy. While these innovations promise increased productivity and efficiency, they also pose challenges related to job displacement and workforce adaptation.

- Impact: Automation will likely lead to increased productivity and efficiency, boosting economic growth. However, it could also result in job losses in certain sectors, requiring workforce retraining and upskilling.

- Implications: Companies will need to invest in technology and adapt their business models to remain competitive. Individuals will need to acquire new skills and adapt to changing job markets.

2. Demographics and Labor Market

The US population is aging, with the number of Baby Boomers retiring and a growing number of millennials entering the workforce. This demographic shift will impact labor supply, consumption patterns, and social security programs.

- Impact: The shrinking workforce could lead to labor shortages in certain industries, putting upward pressure on wages. The aging population could also increase demand for healthcare and retirement services.

- Implications: Businesses will need to attract and retain talent, possibly through offering flexible work arrangements and competitive compensation packages. The government will need to address the long-term sustainability of social security and healthcare programs.

3. Climate Change and Sustainability

Climate change is a growing concern, with potential consequences for the US economy. Extreme weather events, rising sea levels, and resource scarcity could disrupt supply chains, damage infrastructure, and impact agricultural production.

- Impact: The US economy could experience significant costs associated with climate change mitigation and adaptation. The transition to a more sustainable economy will require significant investments in clean energy, infrastructure, and technology.

- Implications: Businesses will need to incorporate sustainability into their operations and products, while individuals will need to embrace eco-friendly practices and reduce their carbon footprint.

4. Global Economic Integration and Trade

The US economy is deeply interconnected with the global economy, with trade playing a significant role in its growth. However, rising trade tensions and protectionist policies could disrupt global supply chains and impact economic growth.

- Impact: Trade wars and protectionist policies could lead to higher prices for consumers, reduced economic growth, and job losses. The US economy could also face challenges from the rise of emerging economies and the shifting global power balance.

- Implications: Businesses will need to diversify their supply chains and explore new markets. The US government will need to navigate complex trade negotiations and maintain a balanced approach to international trade.

5. Healthcare Costs and Access

Healthcare costs continue to rise in the US, posing a significant burden on individuals, businesses, and the government. The debate over healthcare reform continues, with different approaches to address access, affordability, and quality.

- Impact: High healthcare costs could stifle economic growth, reduce household spending, and impact business competitiveness. The lack of universal healthcare coverage could lead to health disparities and economic inequality.

- Implications: Businesses will need to offer competitive healthcare benefits to attract and retain talent. The government will need to find sustainable solutions to address rising healthcare costs and improve access to quality care.

6. Infrastructure Investment and Development

The US infrastructure is aging and in need of significant investment. Inadequate infrastructure can hinder economic growth, reduce productivity, and impact quality of life.

- Impact: Poor infrastructure can increase transportation costs, reduce business efficiency, and limit economic competitiveness. The lack of investment in infrastructure could also lead to safety risks and environmental damage.

- Implications: The government will need to prioritize infrastructure investment, focusing on areas such as transportation, energy, and broadband. Businesses will need to adapt to changing infrastructure needs and potential disruptions.

7. Education and Workforce Development

The US economy will require a highly skilled workforce to remain competitive in the global marketplace. However, challenges remain in ensuring access to quality education and training for all Americans.

- Impact: A shortage of skilled workers could limit economic growth and hinder innovation. The lack of access to quality education could exacerbate income inequality and social mobility issues.

- Implications: The government will need to invest in education and workforce development programs, focusing on STEM fields and skills that are in high demand. Businesses will need to invest in employee training and development to ensure their workforce has the skills needed to succeed.

8. Financial Markets and Monetary Policy

The US Federal Reserve plays a crucial role in managing the economy through monetary policy. Interest rate adjustments, asset purchases, and other tools are used to influence inflation, unemployment, and economic growth.

- Impact: Monetary policy decisions can have a significant impact on the economy, influencing borrowing costs, investment levels, and asset prices. The Federal Reserve’s actions can also influence exchange rates and global financial markets.

- Implications: Businesses and investors need to carefully monitor monetary policy decisions and their potential impact on their operations and investments. The Federal Reserve will need to strike a delicate balance between stimulating growth and managing inflation.

Related Searches:

- US Economic Outlook 2025: This search explores broader projections for the US economy in 2025, considering various factors and their potential impact.

- US GDP Growth 2025: This search focuses on forecasts for US GDP growth in 2025, providing insights into the expected pace of economic expansion.

- US Unemployment Rate 2025: This search examines predictions for the US unemployment rate in 2025, offering insights into labor market conditions and job opportunities.

- US Inflation Rate 2025: This search focuses on forecasts for the US inflation rate in 2025, providing insights into the potential for price increases and their impact on consumer spending.

- US Interest Rates 2025: This search explores projections for US interest rates in 2025, offering insights into borrowing costs and the impact on investment and economic activity.

- US Stock Market 2025: This search examines predictions for the US stock market in 2025, providing insights into potential returns and risks for investors.

- US Housing Market 2025: This search focuses on forecasts for the US housing market in 2025, offering insights into trends in home prices, mortgage rates, and real estate investment.

- US Energy Sector 2025: This search explores projections for the US energy sector in 2025, providing insights into trends in oil and gas production, renewable energy development, and energy consumption.

FAQs

Q: What are the most significant challenges facing the US economy in 2025?

A: The US economy faces several significant challenges in 2025, including:

- Rising inequality: The gap between the rich and poor continues to widen, creating social and economic instability.

- Technological disruption: Automation and AI are transforming the job market, leading to potential job displacement and requiring workforce adaptation.

- Climate change: The economic costs of climate change mitigation and adaptation are growing, requiring significant investment and policy changes.

- Global economic uncertainty: Trade tensions, geopolitical risks, and emerging economies pose challenges to the US economy’s global competitiveness.

Q: What are the key opportunities for the US economy in 2025?

A: The US economy also presents several opportunities for growth and innovation in 2025, including:

- Technological advancements: AI, automation, and other technologies have the potential to drive productivity growth and create new industries and jobs.

- Emerging industries: The growth of sectors like renewable energy, biotechnology, and advanced manufacturing offers opportunities for economic expansion and job creation.

- A skilled workforce: Investing in education and workforce development can create a highly skilled workforce capable of driving innovation and economic growth.

- Global market access: The US has a strong position in the global economy, offering opportunities for businesses to expand into new markets and generate revenue.

Q: How can businesses prepare for the US economy in 2025?

A: Businesses can prepare for the US economy in 2025 by:

- Embracing technology: Investing in automation, AI, and other technologies to improve efficiency, productivity, and competitiveness.

- Developing a skilled workforce: Investing in employee training and development to ensure their workforce has the skills needed to succeed in the evolving job market.

- Focusing on sustainability: Incorporating sustainability into their operations and products to meet growing consumer demand and reduce environmental impact.

- Adapting to global trends: Diversifying supply chains, exploring new markets, and adapting to changing trade dynamics.

- Monitoring economic indicators: Carefully tracking key economic indicators such as GDP growth, inflation, and interest rates to anticipate potential changes in the economy.

Tips

- Stay informed: Regularly read industry publications, attend conferences, and engage with experts to stay updated on economic trends and their potential impact.

- Develop a strategic plan: Create a comprehensive business plan that addresses the potential challenges and opportunities presented by the evolving US economy.

- Invest in innovation: Allocate resources to research and development, new technologies, and product innovation to remain competitive.

- Embrace diversity and inclusion: Create a diverse and inclusive workplace to attract and retain top talent and foster a culture of innovation.

- Engage with policymakers: Participate in industry associations, lobby for favorable policies, and advocate for measures that support economic growth and competitiveness.

Conclusion

The US economy is navigating a complex and dynamic landscape, with numerous factors shaping its future trajectory. While challenges remain, the US economy also presents opportunities for innovation, growth, and prosperity. By understanding current trends, adapting to changing conditions, and embracing opportunities, businesses, investors, and individuals can position themselves for success in the US economy of 2025. The future of the US economy will be shaped by the choices made today, requiring a collective effort to address challenges, seize opportunities, and build a more sustainable and equitable future for all.

-1.png)

Closure

Thus, we hope this article has provided valuable insights into US Economy Trends 2025: A Comprehensive Outlook. We thank you for taking the time to read this article. See you in our next article!